Qatar’s gas expansion

How will Qatar’s plan to boost liquefied natural gas output affect the LNG market and future global energy supply?

Qatar, currently the world’s number one exporter of liquefied natural gas (LNG), recently announced that it will increase production from 77 million tonnes of natural gas to 100 million tonnes a year by 2024.

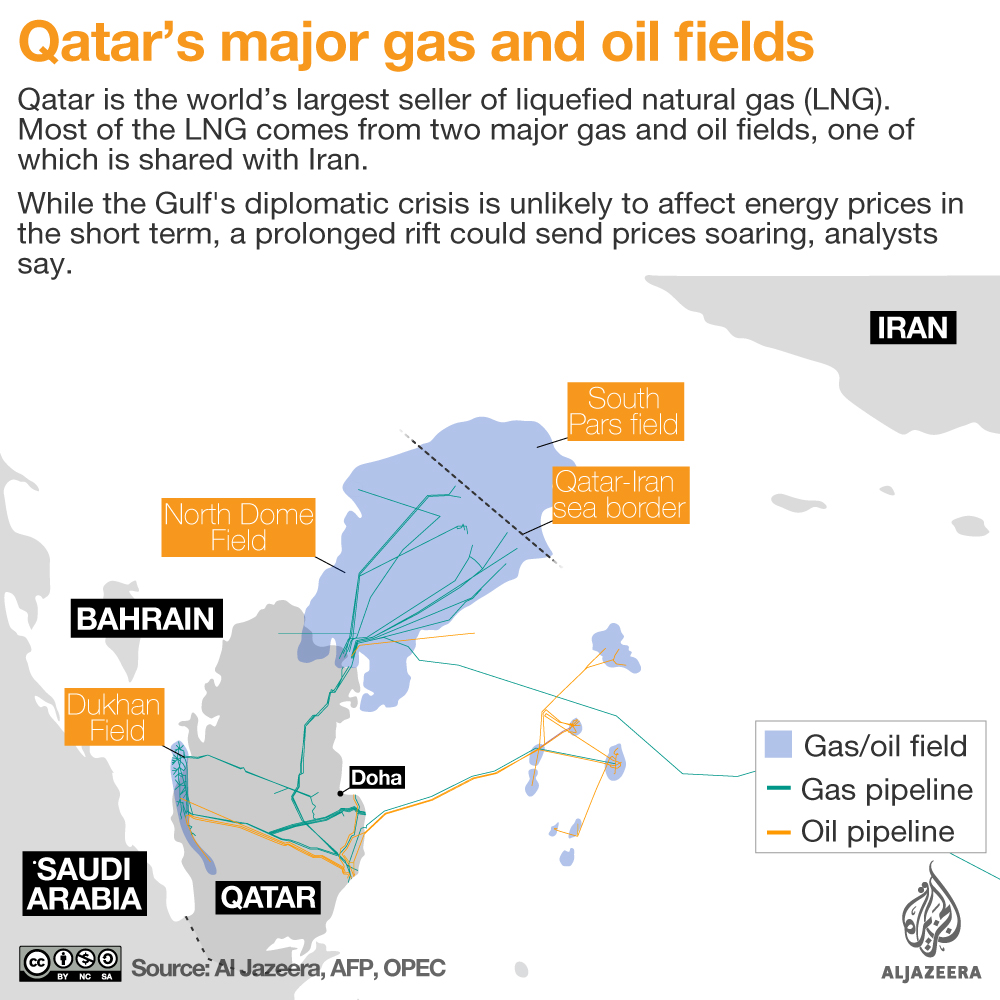

With proven gas reserves of almost 26 trillion cubic metres, the peninsula is home to the world’s third-largest reserves of gas after Russia and Iran. The majority of Qatar’s natural gas is located offshore in the North Field which is shared with Iran.

Keep reading

list of 4 itemsRussia’s Putin eyes greater support from China for Ukraine war effort

India-Iran port deal: A gateway to Central Asia or a geostrategic headache?

India’s income inequality widens, should wealth be redistributed?

Announcing a major expansion of its (LNG) export capacity, they (Qatar) aim at coming onto the market at the moment when supply might be relatively short.

Gas has helped transform Qatar into one of the richest countries in the world, and at current prices, the announced increase in production would translate to revenues of around $30bn.

Corporate energy giants like ExxonMobil, Shell and Total are already lobbying the government to take part in the expansion.

So what does Qatar’s ambitious natural gas expansion plan mean for the LNG market and the world’s future energy supply?

“The demand for LNG is expanding … it has been said that towards 2025 in the first half of the next decade, supplies of LNG might be short and that’s exactly what Qatar is banking upon. Announcing a major expansion of its export capacity, they [Qatar] aim at coming onto the market at the moment when supply might be relatively short,” says Professor Giacomo Luciani from the Graduate Institute of International and Development Studies in Geneva.

READ MORE: Qatar’s battle for LNG market share

According to Luciani, there’s also uncertainty about the future demand of LNG due to the global efforts towards decarbonisation.

“Some people see gas as a source that is very coherent and complementary to renewable energy sources. Others say gas has to be pushed aside like coal and oil in order to fully decarbonise. So there’s an uncertainty about the future of demand. And if you sit on the largest reserves in the world, which is the case of Qatar, you want to make sure that you exploit those before demand disappears because nobody wants to buy gas any longer,” says Luciani.

The announcement to ramp up production comes amid an ongoing crisis between Qatar and several of its neighbours, who have severed diplomatic ties with Qatar and imposed an air, sea and land blockade on the Gulf nation.

Luciani explains why he doesn’t foresee the current GCC crisis affecting Qatar’s gas exports:

“What we see around the world is gas trade tends to be immune from political or security interference. Russia and Ukraine, for example, are basically at war. Nevertheless, gas continues to flow from Russia across Ukraine. I think both sides understand an interruption of the flows or interference of the flows would be perceived as a very significant escalation and potentially an act of war. Qatar, of course, can utilise international waters for shipping LNG to the rest of the world and any interference with those shipping lanes would be perceived as unacceptable by everybody else in the world.”

Also on this episode of Counting the Cost:

China’s Internet future: Facebook, YouTube, Twitter and even Instagram are all blocked in China. In the past, if you needed uncensored access to the internet in China you would have to use a VPN. But new internet laws mean the government is cracking down on online entertainment, live streaming, VPNs and even mobile gaming. China’s internet works more like a private network except it has nearly 700 million users. And that’s exactly why the government in China is watching social media so closely. It wants to control the conversation and it already has a staggering amount of data on its citizens. Andy Mok, the founder and managing director of “Red Pagoda Resources”, a Beijing-based professional services firm, discusses China’s Internet future.

EU-Japan free trade: Japan and the European Union agreed on an outline for a massive trade deal this week that will rival the size of NAFTA, the free trade accord that the United States has with Canada and Mexico, currently the largest one in the world. Claus Vistesen, the chief eurozone economist with Pantheon Macroeconomics, assesses what’s in the agreement and why it matters.