The giants of commodity trading

Switzerland’s commodities sector has grown spectacularly over the past decade, but is it an industry beyond the law?

Is it an industry beyond the regulators and law? Are the players speculators, cynical manipulators or crucial linchpins in a global trade?

From Switzerland to the world – they are the giants of commodity trading, but can they shake off the tag of ‘modern day slave masters’?

This week on Counting the Cost we examine the commodities industry – the very essentials, the raw materials and resources that we simply cannot live without. These are traded all over the globe – everything from oil to copper, sugar to precious minerals.

The industry is large, very large. Collectively, we are talking over $3 trillion of world trade in commodities. But believe it or not, the dominant player in all this is Switzerland and the Lake Geneva region. A staggering 25 per cent of world commodities trade goes through that tiny country alone after experiencing strong growth over the last two decades.

A country normally associated with great lakes, political neutrality and the Red Cross can now be associated with the global commodities industry as Switzerland is home to some of the biggest commodities companies in the world.

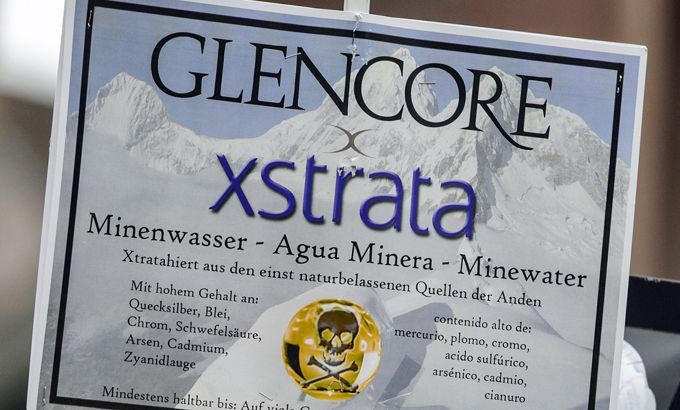

The Vitol group, which primarily trades and distributes oil, had a turnover in 2011 of $297bn. And the Geneva-based Glencore, which trades in just about everything, turned over $186bn in the same year.

But why has that one region out surpassed the others in the commodities business? And is it possible to regulate the globalised, multi-billion dollar companies which operate within it?

Along with the billions of dollars in profits there have been a number of human rights scandals, which have forced the normally reclusive commodities companies into the spotlight. And while these powerful companies experience an unprecedented boom, the population of many resource-rich developing countries remain mired in poverty.

Oliver Classens, the media director of the Berne Declaration in Switzerland told Counting the Cost: “These trading companies often accept high risks … There are affected communities out there and a lot of environmental damage in places such as DRC, Colombia and other places.”

We hear from Al Jazeera’s Gabriel Elizondo in Bolivia where Evo Morales, Bolivia’s president, nationalised a mine belonging to the Swiss mining giant Glencore in June 2012. The move was an effort to end a conflict between miners attempting to take control of the country’s second-biggest tin mine by force. But Bolivia has other troubles: underage miners as young as 11 and many are dying from lung disease.

We also speak to Savior Mwambwa, the executive director of Zambia’s Centre for Trade and Policy Development, and Martin Fasser from the Zug Commodity Association, asking whether the industry is beyond the regulators and law. Should these companies do more to avoid the human rights scandals they have been involved in?

Watch each week at the following times GMT: Friday: 2230; Saturday: 0930; Sunday: 0330; Monday: 1630. Click here for more Counting the Cost. Follow Kamahl Santamaria @KamahlAJE and business editor Abid Ali @abidoliverali |