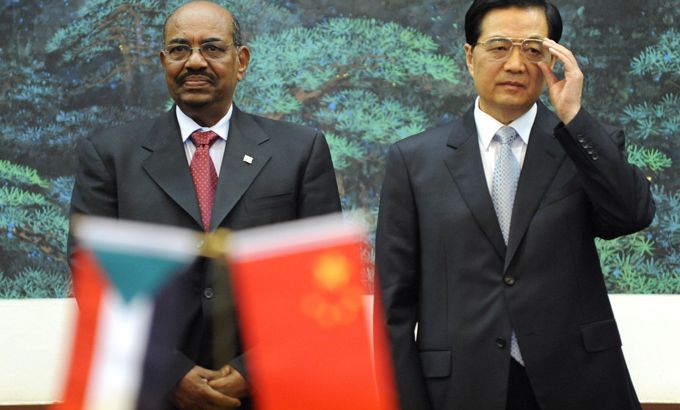

China and the two Sudans

Can there be profit without politics for the biggest investor in the two uncomfortably interdependent countries?

On this week’s show we take a look at China in Africa and ask if there can be profit without the politics.

The short story is one of a country big on investment but reluctant on politics. But in a country like Sudan, oil, money and politics are difficult to separate.

Keep reading

list of 4 itemsShip that caused deadly Baltimore Key bridge collapse towed to port

‘Why should we vote?’ India’s jute workers blame politicians for woes

California farmworkers cheer new housing in town scarred by mass shooting

Last year, before South Sudan split from Sudan, the Chinese were buying 260,000 barrels of crude from Sudan every day.

But then the South broke away, leaving unclear borders and a dangerous split in the oil resources. South Sudan ended up with 75 per cent of the oil reserves – which equates to roughly 500,000 barrels a day. That accounts for 98 per cent of South Sudan’s income – all of which must run through pipelines to the north, in Sudan. South Sudan had hoped that China would help fund a new pipeline to enable it to escape Khartoum’s chokehold on its oil. But Beijing declined, leaving the two countries tied together in an uncomfortable interdependence.

China has been famously reluctant to get involved in conflicts like the one between Khartoum and Juba – preferring to focus on business rather than diplomacy. But this dispute is different. China’s biggest money is in oil – a resource that straddles the border. And both Sudans depend so deeply on oil that neither can pay their bills without it – including their debts to China, the biggest investor in both countries.

China may have the most to lose but it also has the greatest influence over both countries. So, can it protect its investments – even if that necessitates turning to diplomacy? And might the very thing that Sudan and South Sudan have been fighting over be the one thing that could bring them back to the negotiating table?

Also, why a break-up of the eurozone may be a bad idea.

The eurozone and the euro are not perfect, but the cost of any break-up would be unimaginable. We are talking about a worst-case scenario of civil unrest and the imposition of authoritarian governments – at least that is the view of the Swiss bank UBS, whose global economist Paul Donovan speaks to Counting the Cost.

Plus, Canadians are being told by their government to borrow less money as household debt climbs to near record levels. It is a bit of a blow for an economy that weathered the financial crisis better than most. Counting the Cost explores Canada’s growing debt problems.

And finally, we find out how a strong economy is helping Turkey to become one of the frontrunners to secure the 2020 Olympics.

Watch each week at the following times GMT: Friday: 2230; Saturday: 0930; Sunday: 0330; Monday: 1630. Click here for more Counting the Cost. Follow Kamahl Santamaria @KamahlAJE and business editor Abid Ali @abidoliverali |