It’s still inequality, stupid

Persuaded in Davos that Europe will not collapse, Western capitalism is free to focus on fabulous profits in Asia.

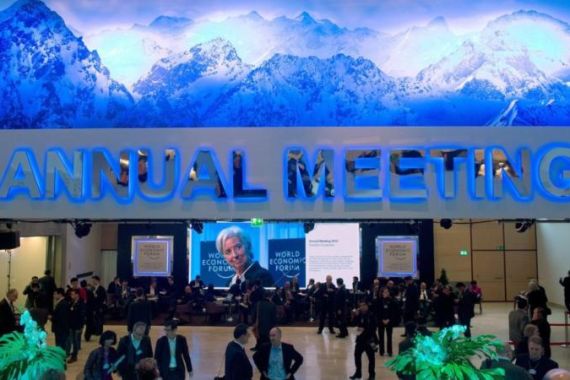

So what came out of the supposed Masters of the Universe – in government, business, the economy, technology – discussing “Resilient Dynamism” at the World Economic Forum in Davos?

Not much – apart from the title of the address by the head of the IMF, the metronomic yet sartorially irreproachable Christine Lagarde. Madame Lagarde quoted figures most were already familiar with; in 2013 the developed world will grow 1.5 percent; the developing world, 5.5 percent.

The Masters of the Universe also sashayed through – no, we’re not making this up – “Catalyzing Multi-stakeholder Value” and “Sailing Towards a Circular Economy” round tables.

Madame Lagarde insisted 2013 will be a “make or break year”. That was another way of putting that Davos this year was pure East (does not) meet West.

Everything depressed, resigned-to-zero-growth West needed to know was what Mario Draghi, the president of the European Central Bank (ECB) essentially reiterated. The ECB would do “whatever it takes” to prevent a break-up of the euro – including buying up bonds of desperate eurozone nations in dizzying amounts.

That was a sobering break from the ceremonial global elite bashing of national borders as nefarious to globalisation.

East, for its part, was beaming. As Adi Godrej, president of the Indian club of top industrialists put it, after Japan and South Korea, then the Asian tigers, and then China and India, “the global market is rapidly transferring to Asia”.

Or, as Prijono Sugiarto, president of Indonesian giant PT Astra illustrated, “Indonesia is a country of 280 million people; 20 years ago we were the 28th economy in the world, now we’re 16th and in 2030 we will be 8th.”

Another way of seeing it is the whopping $10 trillion China and India will be consuming by 2020, with both their middle classes, in ten years, reaching 1 billion people, and surging from 28 percent to 50 percent of the global middle class.

Inevitably Davos – as in Western turbo-capitalism – could not but get dizzy with these potential Himalayas of profit. Thus the dedicated round table delving on the myriad implications of the “explosive opportunity” offered by a billion voracious Asian consumers. As for how the planet’s resources will cope, who cares?

The less than zero crowd

Back to Western talk – it was mostly doom and gloom.

Billionaire speculator George Soros was certainly the gloomiest. In a sweeping generalisation, he predicted the world is entering a period of “evil”. The US will face “riots on the streets that will lead to a brutal clampdown that will dramatically curtail civil liberties. The global economic system could even collapse altogether”.

Why? Soros must have read Al Jazeera English; It’s inequality, stupid.

|

|

| World Economic Forum wraps up in Davos |

Soros certainly upstaged New York University Professor Nouriel “Dr Doom” Roubini, who limited himself to un-dramatically remark that the euro crisis was “less worse than it was last summer” although “the politics of Europe could worsen”. This Roubini-on-Valium version was essentially echoing ECB president Mario Draghi.

Asked what to do to fight youth unemployment, Italy’s Mario Monti could only come up with “some tax relief” for companies deciding to hire young people, and a vague “labour market reform”. Even Silvio “Bunga Bunga” Berlusconi can cook something misleadingly sexier for the Italian elections next month.

Meanwhile, youth unemployment in Spain has already reached a staggering 60 percent. According to the International Labour Organisation (ILO), more than 200 million people around the world are unemployed (at least 4 million added in 2012). Two-fifths of the jobless are under 25.

The ILO is adamant; this sate of affairs is a major threat to social stability; and austerity has to go. One doesn’t need to be Christine Lagarde to know this was all aggravated by excessive public spending cuts and tax increases.

Britain – after its economy shrank 0.3 percent in the last quarter of 2012 – is not much better, now on a triple-dip recession. Growth in 2012 was literally zero.

It took Dutch Prime Minister Mark Rutte to helpfully explain that Britain outside the EU would be just an island in the middle of the ocean, somewhere between Europe and the US. And growing less than zero.

Oh, if only the West was a giant Denmark. Danish Prime Minister Helle Thorning-Schmidt said the solution to all ills was to run “a very tight budget”. That’s why Denmark became a safe haven in Europe; “We have reformed the tax system, early retirement, benefits, schooling. This is necessary to preserve the well-developed welfare state we want to have.”

Of course that’s possible in a small, wealthy country of less than 6 million people. And thank those state funds for allowing Danish TV to produce Scandinavian noir masterpieces such as The Killing.

A solution, of course, is innovation – something that Germany and Belgium [PDF], for instance, are good at, with Sweden not far behind.

And then, of course, there’s Boris. The inimitable PR superstar Mayor of London, Boris Johnson, said he would soon publish his vision of how the city’s economy should work by 2020. That means proposals such as building hundreds of thousands of new homes, investing in road and rail infrastructure, boosting startups clustered at London’s Tech City, keeping low taxes, and a new airport. Sounds like… China.

And now for the real struggle

Speaking of the Middle Kingdom, HSBC organised a breakfast to discuss whether the yuan will be the next global reserve currency.

Barry Eichengreen, from the University of California, answered the obvious; yes. Even though not everyone at Davos knew that when Beijing officially speaks of “promoting yuan globalisation”, that’s exactly what it means.

So here it is, in a nutshell. The Masters of the Universe had to reassure themselves that Europe is not falling into the abyss even while Western corporations are only focused on how much profit they can extract in Asia.

What Immanuel Wallerstein has been analysing for over a decade – capitalism’s protracted structural crisis – was once again imperially ignored. Yet the grassroots political struggle – on a global level – remains more pressing than ever.

From Patagonia to Tahrir Square, people instinctively know that more turbo-neoliberalism will only lead to more polarisation – and that amorphous “evil” Soros was smart enough to acknowledge (but not precise enough to conceptualise).

So suppose you’re young, well-educated, unemployed, with no prospects – and very angry. How to join the long march towards relatively democratised economic relations, and a relative egalitarianism?

Don’t expect Davos to come up with answers. A good starting guide could be Meme Wars: The Creative Destruction of Neoclassical Economics.

It bills itself as a “real world economics textbook”, and comes from Kalle Lasn and those enterprising folks at Vancouver-based Adbusters (fabulous graphics, excellent selection of texts). It’s about “the battle for the soul of economics”. Read it. Take risks. And fight the nothingness.

Pepe Escobar is the roving correspondent for Asia Times. His latest book is named Obama Does Globalistan (Nimble Books, 2009).