India’s income inequality widens, should wealth be redistributed?

Rising income inequality is a hot topic dominating the national elections.

Rising income inequality is a hot topic dominating the national elections.

A weekly look at the world’s top business and economics stories. Watch Counting the Cost every Friday 2230GMT

India is the world’s fifth-largest economy. The World Bank says the nation is leading growth in South Asia.

Falling fertility rates could bring about a transformational demographic shift over the next 25 years.

Global nuclear power generation is set to peak next year, despite claims it is dangerous and costly.

Britain is cutting taxes for workers again ahead of elections.

The US economy is remarkably strong. But, borrowing costs are high and many Americans can’t afford to buy a home.

Farmers in different parts of the world are protesting against economic and climate policies.

India’s economy is shifting away from agriculture to manufacturing.

Moody’s has lowered Israel’s credit rating for the first time and forecast a negative outlook for the economy.

The US economy is on a tear, and it has pulled far ahead of the rest of the world.

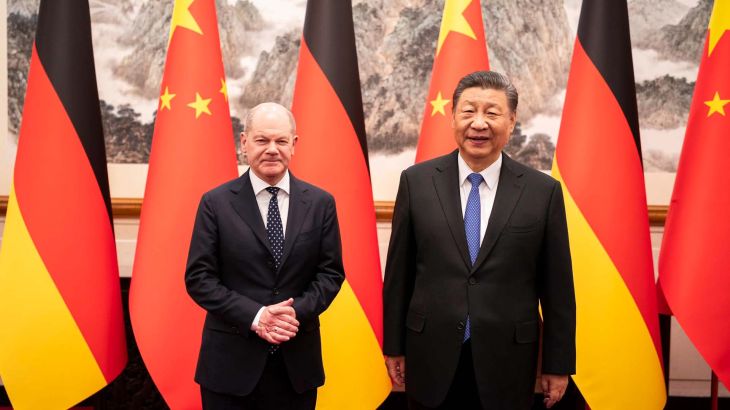

Chinese officials signal their concerns by taking measures aimed at reviving growth and steadying markets.