Wall Street gripped by uncertainty

Despite a rally, many experts believe the global financial chaos is set to continue.

|

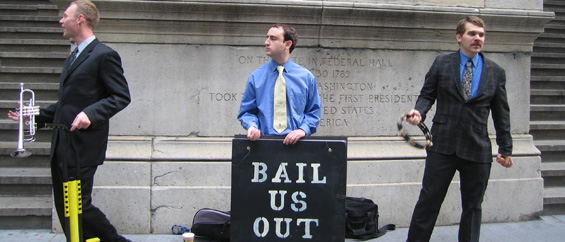

| Street performers are cashing in as Wall Street bankers fall on hard times |

An apocalyptic air has enveloped Wall Street that is unlikely to be fully lifted by short-term stock market rallies, no matter how large.

The financial crisis has sparked widespread criticism of Wall Street and small groups of protesters have been gathering at the entrance to the New York Stock Exchange (NYSE) to greet grim-faced traders with cries of “the party’s over!” as they arrived early for work.

Keep reading

list of 4 itemsShip that caused deadly Baltimore Key bridge collapse towed to port

‘Why should we vote?’ India’s jute workers blame politicians for woes

California farmworkers cheer new housing in town scarred by mass shooting

A group of street performers, dressed as businessmen, also put on a show opposite, asking passers-by for a “bailout” in exchange for their performance.

Another man waving a red flag stands outside the entrance to the building, declaring that the crisis marks “the end of capitalism”.

More demonstrators came and went throughout the day, alongside hundreds of tourists, adding to the sense that Wall Street, once respected by many as the centre of US free-market capitalism, is facing a very public humiliation.

While those working in the US financial sector must be hoping that the recent joint efforts of governments to address the crisis may keep capitalism alive, many on the famous street are pessimistic about the future amid the turbulence.

Despite Monday’s rally, many traders and analysts on Wall Street believe that the global financial chaos that has frozen credit markets is set to continue.

“Its been hectic and there’s been a lot of anxiety while we’ve been waiting for decisions to be made by the various institutions,” says John Doyle, an independent broker on the floor of the NYSE.

“It’s not over, not by a long shot,” he told Al Jazeera.

‘There are crooks’

Further down Wall Street, which has been home to the major US financial markets for more than 200 years, another side to the impact of the global financial turmoil is on display.

|

| Polychronakis’s business is dependent on the success of financial markets |

Minas Polychronakis, a 66-year-old from Greece who arrived in the US 39-years ago, runs a shoe-shine and repair shop not far from the exchange.

He says the mood among his customers has changed since the turmoil began.

“I’m very scared for the young guys who work here,” he said.

“Before, they came in here and were laughing and joking with us, but now they don’t say anything.

“Before they had secure jobs – but now it’s different.”

Polychronakis, who has plied his trade since 1970, has already lost his business once in recent years, when his original shop was destroyed in the September 11 attacks on the World Trade Center.

Minas Shoe Repair Inc is typical of many service industries based in the area that depend on the success of the financial markets and their employees to survive.

Having only reopened his business in 2004, he remains concerned about what lies ahead.

“Now, it’s a busy time just before winter and people want their shoes repaired, but in the future … who knows?”

But a financial crisis could also bring some benefits, he says, as more people get their shoes repaired instead of buying new ones.

The greater threat to his business, he says, comes from the flight of banks and financial institutions from Wall Street itself, as firms move out to cheaper locations.

Polychronakis echoes the views of many Americans when asked who is to blame for the crisis.

“There are crooks up there,” he says gesturing in the direction of the NYSE.

Little sympathy

Wall Street has come in for some fierce criticism from many people in the US since the crisis began, some of it from Barack Obama and John McCain, the Democratic and Republican US presidential election candidates.

The subprime mortgage crisis, which began after thousands of Americans were unable to repay high-interest loans on their homes amid claims of predatory lending, has hit many across the country hard.

From some on Wall Street, however, there is little sympathy.

“There isn’t any problem [on Wall Street],” says Doyle. “The problem is with people themselves living beyond their means.”

|

| Sankari admits Wall Street may have to change to survive |

But the decision to pump billions of dollars of taxpayers’ money into the private finance system has led to demands for greater regulation amid protests against what many call the excesses of the financial firms who profited from the sale of subprime mortgage securities around the world.

Ammar Sankari, a financial expert who works on the NYSE, is among many on Wall Street who admit that it may now have to change if it is to survive.

Sankari says that the government needs to make sure well-placed strings are attached to bailout legislation to make sure the sale of those kind of securities is properly controlled.

“Normally, we in the markets don’t like regulation, but it was that unregulated way that led to this crisis and we have to accept that crises happen.”

“If we don’t have tighter regulation, then the crisis will happen again in maybe five, 10 or 20 years.”