US Federal Reserve to launch $400bn stimulus

Central bank hopes move will drive down long-term interest rates, make home loans cheaper and invigorate economy.

|

|

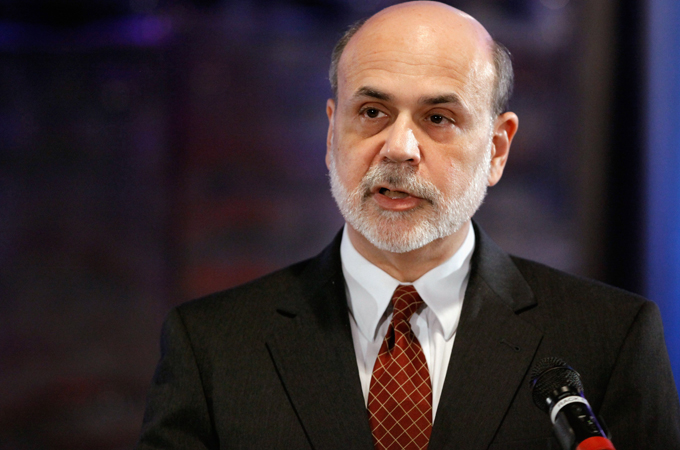

Republican leaders had earlier written to Bernanke, urging him not to launch another intervention [GALLO/GETTY] |

The US Federal Reserve has announced that it will launch a new $400bn programme to help the beleaguered US economy by attempting to exert downward pressure on long-term interest rates and to aid the battered housing sector.

In a statement released on Wednesday, the central bank said that its programme would tilt its $2.85tn balance sheet more heavily towards long-term securities by selling short-term notes and using those funds to buy longer-dated treasuries.

Keep reading

list of 4 items‘We need you’: Solomon Islands’ support for US agency’s return revealed

Why are nations racing to buy weapons?

Parallel economy: How Russia is defying the West’s boycott

It will also be reinvesting proceeds from maturing mortgage and agency bonds back into the mortgage market.

“Recent indicators point to continuing weakness in overall labour market conditions, and the unemployment rate remains elevated,” the Fed said in its statement.

Policymakers from the bank announced the move on Wednesday after a two-day meeting. Three out of ten members were against the move, the most to do so on a decision for nearly two decades.

On Thursday, Asian stock spreads dropped heavily after the Fed’s pessimistic announcement and worries about the European banking system rippled through financial markets.

Financial bookmakers early on Thursday morning expected leading European benchmark indexes to fall sharply as a result of the Fed’s announcement and said it faced “significant downside risks”.

Recession fears

Faced with an unemployment rate of 9.1 per cent, low consumer and business confidence, a downgraded US credit rating and an escalating sovereign debt crisis in Europe, officials at the Fed signalled that they were seeking to prevent slow economic growth from stagnating completely.

The economy grew at an annual rate of just 0.7 per cent in the first six months of 2011. August saw no new jobs being added to the market and stagnant consumer spending on retail goods.

Most economists say growth for the entire year will likely be less than two per cent, and that the odds of another recession are one in three.

US stocks and gold prices fell immediately following the announcement on Wednesday.

Many analysts say the shift in the Fed’s portfolio could provide some help to the US economy by reducing borrowing costs.

Others, however, warn that the move could escalate inflation.

In June, the Fed completed a $600bn bond-buying programme that may have helped keep rates low.

Expectations of the Fed’s decision led investors to buy up US Treasuries.

Republican criticism

The central bank’s decision to take an active role in attempting to right the faltering US economy, however, has been met with criticism from top Republican political leaders.

Republican congressional leaders wrote to Bernanke this week, urging the central bank to refrain from further economic interventions.

Rick Perry, the governor of Texas and frontrunner in the race for the Republican nomination for president, has gone as far as to say that Bernanke would be “almost treasonous” to launch more bond buying.

Fed officials say that shifting their bond holdings may encourage mortgage refinancing and investments in riskiers assets such as corporate bonds and stocks, without driving up consumer prices.

The Fed is not the only central bank concerned about the state of long-term interest rates.

On Wednesday, the Bank of England signalled that it was ready to pump more money into the weakening British economy, potentially as soon as October.

The International Monetary Fund warned on Tuesday that the US could fall back into recession if the government tightened its budget too quickly.

It recommended the Fed consider a further easing of monetary policy as long as there was no sign that an inflationary psychology was taking root.

The US central bank has already taken aggresive measures to ease monetary policy, cutting overnight interest rates to near zero in December 2008 and then moving to more than triple its balance sheet to $2.8 trillion through a series of bond purchases.