Russia’s economy projected to shrink by 10%; Ukraine’s by 20%

The European Bank for Reconstruction and Development says war has triggered ‘greatest supply shock’ in 50 years.

The economies of Russia and Ukraine will shrink by 10 percent and 20 percent respectively in 2022, according to the European Bank for Reconstruction and Development (EBRD).

In its first economic forecast since Russia’s invasion on February 24, the London-based lender warned on Thursday that the war had triggered “the greatest supply shock since at least the early 1970s” and would have a severe effect on economies far beyond the immediate area of the conflict.

Keep reading

list of 4 itemsRussia-Ukraine war: List of key events, day 792

Risk of military incidents on Belarus-Ukraine border quite high: Lukashenko

Ukrainians sigh with relief as US unlocks aid but say it won’t repel Russia

The EBRD, issuing emergency forecasts based on a series of assumptions about events in the coming months, said it was the first international financial institution to update its guidance since the outbreak of the war in Ukraine five weeks ago. Previously, it had been expecting growth of 3.5 percent for Ukraine and three percent for Russia.

The latest prognoses “assume that a ceasefire is brokered within a couple of months, followed soon after by the start of a major reconstruction effort in Ukraine,” the multilateral bank said.

Under such a scenario, Ukraine’s war-battered gross domestic product should rebound by 23 percent next year.

But the heavy and far-reaching economic sanctions imposed on Russia by Western countries would mean that it would register zero growth.

“Sanctions on Russia are expected to remain for the foreseeable future, condemning the Russian economy to stagnation in 2023, with negative spillovers for a number of neighbouring countries in eastern Europe, the Caucasus and Central Asia,” the EBRD said.

“With so much uncertainty, the bank intends to produce a further forecast in the next couple of months, taking into account further developments.”

Belarus, which also faces Western sanctions over its role in the conflict, was forecast to shrink by three percent this year and then stagnate in 2023.

Supply shock

Founded in 1991, the EBRD works in many emerging economies across eastern, central and southeastern Europe, Central Asia, Turkey and the southern and eastern Mediterranean.

It predicted that its investment zone, excluding Belarus and Russia, would grow by 1.7 percent this year, less than half of the previous growth forecast of 4.2 percent in November.

Growth is then expected to pick up to five percent in 2023.

“Projections are subject to an exceptionally high degree of uncertainty, including major downside risks should hostilities escalate or should exports of gas or other commodities from Russia become restricted.”

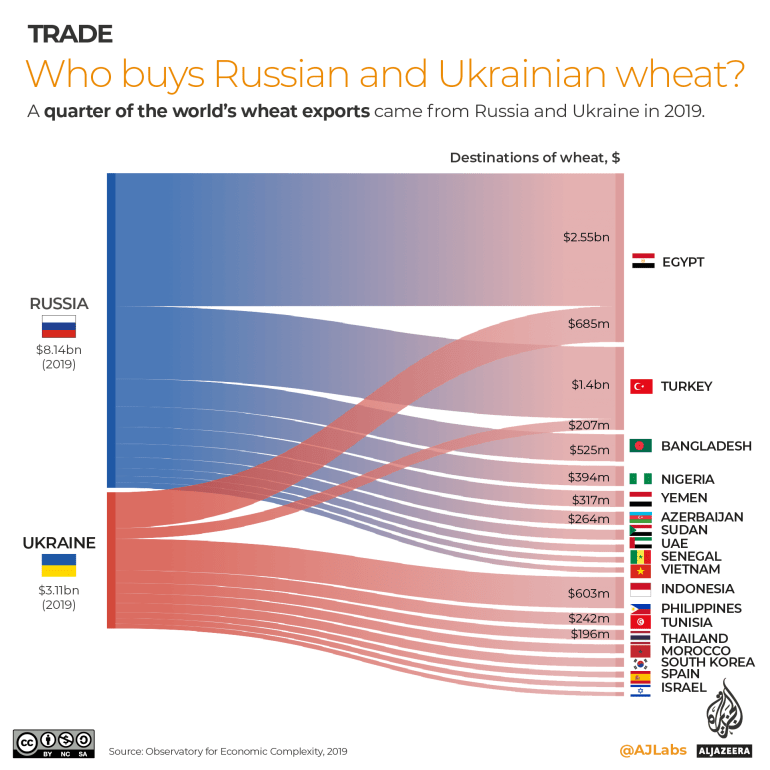

The world economy faced “the greatest supply shock since at least the early 1970s”, it said, pointing out that Russia and Ukraine “supply a disproportionately high share of commodities, including wheat, corn, fertiliser, titanium and nickel”.

EBRD chief economist Beata Javorcik said that inflationary pressures, which were already high before the invasion, “will certainly increase now, which will have a disproportionate effect on many lower-income countries where” the bank invests, “as well as on the poorer segments of the population in most countries”.

The head of the African Development Bank told Al Jazeera this week the war would have a rippled effect on food security and energy supply.

In its update, the EBRD said North African countries and Lebanon were “greatly exposed” to the reduced global supply of wheat from Russia and Ukraine, two of the world’s biggest exporters.

It also warned that Central Asian economies that are heavily dependent on remittances from Russia have been badly hit by the fall in the value of the rouble and restrictions on its convertibility. Meanwhile, tourism is expected to take a hit in a number of countries including Armenia, Estonia, Georgia and Montenegro.

The bank earlier this month unveiled a $2.2bn “resilience” package to help citizens, companies and countries affected by the war in Ukraine, including those hosting refugees.

“Europe has also seen the greatest forced displacement of people since the Second World War, and the report examines the potential consequences of this migration,” it said.

“Skilled workers from Ukraine may provide a boost to some economies in the longer term, particularly in countries with ageing populations,” it said.

But “in the short-term, economies are facing fiscal pressures and administrative challenges as they scale up the provision of housing, healthcare and schooling”.

The EBRD, which has condemned Russia’s invasion of Ukraine, said on Tuesday that it will close its Moscow and Minsk offices in an “inevitable outcome of the actions taken by the Russian Federation with the help of Belarus”.

The group has not undertaken any new investment projects in Russia since 2014, when Moscow invaded and then annexed Crimea.