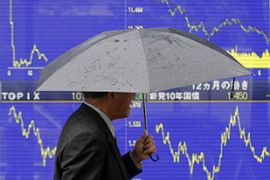

Asian markets in free fall

Japan’s Nikkei index makes its biggest one-day fall in more than 20 years.

| IN DEPTH | ||

|

|

Taro Aso, the Japanese prime minister, said the fall was “beyond our imagination”.

“We have huge fears going ahead,” he said. Japan is the world’s second largest economy.

US stocks slumped more than 500 points to a five-year low at the close of trading on Tuesday as the financial turmoil continued.

The Dow Jones was down 508 points, or 5.1 per cent, despite assurances from George Bush, the US president, that the nation would overcome the crisis.

Elena Torrijos, managing editor of The Asian Banker, told Al Jazeera that further declines should be expected over the next few days.

“To a large extent there is an over-reaction in the markets, but no one will argue that we are seeing a grimmer economic outlook globally.

“You are seeing the soft markets suffering. For example, in Indonesia, a lot of stocks went down because companies are suffering in the area of exports. A lot of Asian companies are going to see slower growth.”

Rate cut signal

Ben Bernanke, the chairman of the US Federal Reserve, said that the economy was likely to remain “subdued” for the rest of this year and into 2009 despite the government’s $700bn bailout plan.

“The outlook for economic growth has worsened,” he said on Tuesday in Washington DC.

“The heightened financial turmoil that we have experienced of late may well lengthen the period of weak economic performance and further increase the risks to growth.”

He also said the risk for inflation had eased with the falling prices for oil and other commodities, giving a strong signal that interest rates might need to be cut.

“In light of these developments, the Federal Reserve will need to consider whether the current stance of policy remains appropriate,” he said.

Frantically trying to stop the bleeding on Wall Street, the Federal Reserve also moved to get cash directly to businesses, invoking emergency powers to lend money to companies outside the financial sector and buy up mounds of “commercial paper”, the short-term loans that companies use to pay for everyday expenses such as salaries and supplies.

Fears that loans will not be repaid has made it both difficult and expensive for businesses and consumers to borrow money.

Finance ministers from the G7 industrialised nations will be meeting in Washington DC this weekend to tackle the global financial crisis.