Back to bolivar? Venezuela makes bid to revive local currency

For years, the bolivar drifted towards irrelevancy as locals embraced the use of the US dollar.

For years, the bolivar drifted toward irrelevancy as Venezuelans embraced the economic stability brought on by the widespread use of the U.S. dollar.

But the Socialist regime, always reluctant to fully turn its economy over to the dollar, is now making a surprise bid to revive the local currency. Emboldened by surging oil exports that are fueling economic growth and helping keep the foreign-exchange rate steady, the government is pushing Venezuelans to use the bolivar more by slapping a 3% tax on purchases made with dollars in shops, restaurants and grocery stores.

Keep reading

list of 4 itemsVenezuela’s army collaborated with Colombian rebel groups: HRW

Venezuela’s Nicolas Maduro, US confirm talks amid Russia crisis

Has the Venezuelan bolivar finally bottomed out?

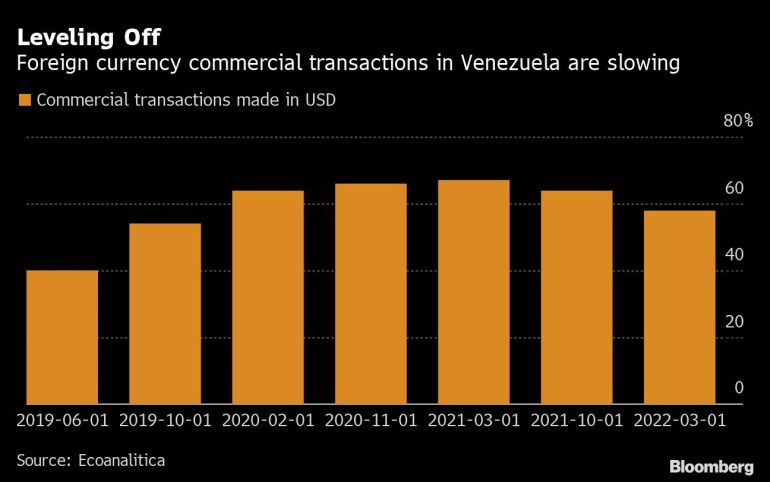

One study done by a private firm indicates there was a slight shift away from the dollar in the days after the tax took effect. A separate report released Tuesday found the use of bolivars in Caracas rose sharply in April, the first full month after its introduction.

The move is a sign that President Nicolas Maduro is increasingly confident the economy is on solid footing after a series of free-market reforms and that Venezuelans believe his government will manage to prevent a return of the kind of hyperinflation that ravaged the country for years. But it’s a high-risk strategy that could backfire given the length and depth of the economic collapse — the worst in the Western Hemisphere in decades — and the tepidity of consumer and investor confidence.

The tax threatens to push businesses further into informality and undermine the government’s inflation-fighting strategy, said Giorgio Cunto, senior economist at Ecoanalitica, the Caracas-based consultancy that carried out the study on dollar transactions. Firms and individuals will demand more bolivars to make payments, which may create additional pressure in the exchange market.

“If that pressure is more than the central bank can handle, we would see an increase in the exchange rate,” Cunto said. “It could hinder the incipient recovery that continues to be very fragile.”

Over the past six months, the bolivar has fallen 7% against the dollar, unfamiliar territory considering it used to lose nearly all its value every year, leading the central bank to slash 14 zeros from it since 2008. The government has a long way to go before people trust enough in the currency to switch from dollars, especially with inflation still running at an annual clip of around 99%, according to the Bloomberg Cafe con Leche Index.

Policy makers tend to wrongly assume that it is possible to revert dollarization once inflation is under control, said Daniel Cadenas, economist and professor at the Venezuela’s Central University, pointing to cases such as Peru, where the use of the dollar is still common despite decades to combat it.

“Dollarization is not going to be reversed,” he said. “The cost for economic actors of going back to thinking in bolivars is higher than the benefits. As long as it remains so, dollarization will persist.”

Instead of fully eliminating the dollar, the government is likely trying to strike a balance between the use of the two currencies, economists said.

Chaotic Roll Out

For many who have become accustomed to the greenback, the tax came as a shock. Even Maduro himself had pushed Venezuelans to embrace the use of the dollar, which helped lead the country out of a period of hyperinflation and made every day purchases easier.

The government has offered scant explanation for why the tax is needed, though leaders have repeatedly vowed to defend the bolivar and resisted dollarizing the financial system, despite lobbying from business leaders.

With little information offered about how to apply the levy, its introduction on March 28 caused confusion. Half of businesses were not able to collect it a month after it went into place, according to estimates from the largest commercial association, Consecomercio.

Some stores temporarily stopped taking dollars altogether. Others displayed the official government order to convince skeptical shoppers that the tax was real. Customers asked if it was being collected before deciding to make purchases. The percentage of purchases made with the dollar fell to the lowest level since 2019, according to the Ecoanalitica study.

Many merchants resorted to manual record-keeping as buying new accounting systems was so expensive that state-owned banks had to offer loans. Several large businesses with multiple registers, such as supermarkets, haven’t been able to adjust.

For industry leaders, the main gripe is that the tax has a cumulative effect. Since the entirety of the production chain is dollarized, the impact on the final price of locally manufactured goods could be exponentially higher than 3%, which would drive inflation.

“The rate is extremely high,” said Luigi Pisella, president of the largest industry guild, Conindustria, which is proposing the government cut the rate to below 0.5% and make the tax temporary. “Local production is going to be much more affected than imported goods.”

(Updates to include Caracas study in 3rd paragraph)