S&P 500 claws back from the brink of a bear market

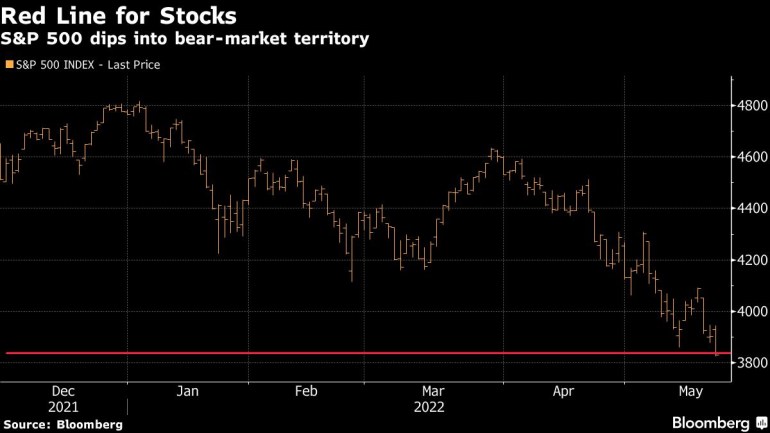

A selloff earlier sent the S&P 500 down more than 20 percent from a January closing high, meeting the common definition of a bear market.

A dramatic late-session rally brought the S&P 500 back from the brink of a bear market, but the index still sank for a seventh straight week in a stretch of weakness not seen since 2001.

The benchmark closed the day little changed, after a selloff earlier sent it down more than 20% from a January closing high, meeting the common definition of a bear market. At the end of another volatile week, the monthly expiration of options tied to equities and exchange-traded funds exacerbated price swings. Treasuries gained with the dollar as havens caught bids.

Keep reading

list of 4 itemsUS stocks fall in another volatile day of trading

Asian stocks dive after Wall Street selloff over inflation, COVID

US stocks suffer biggest daily drop in almost two years

In a week marked by buy-the-dip, sell-the-rally price action, investors grappled with concerns about an economic slowdown and prospects for more monetary tightening, while retailers signaled the mounting impact of high inflation on margins and consumer spending.

The S&P 500’s seventh weekly decline marked the longest losing streak since the dotcom bubble burst more than two decades ago. It’s just its fourth streak of seven or more weekly losses in the post-World War II period, according to Bespoke Investment Group.

“It’s a small sample size, but these types of streaks haven’t occurred during particularly positive periods for the equity market,” wrote the firm’s strategists in a note. “The root causes of the weakness have been the hawkish FOMC and increasing concerns over the potential for a recession.”

In the latest developments over Russia’s war in Ukraine, the Senate passed a more than $40 billion Ukraine aid package, sending the bill to President Joe Biden for his signature. Meanwhile, the Group of Seven industrialized nations will agree on more than 18 billion euros ($19bn) in aid for Ukraine, according to German finance minister Christian Lindner.

What damage will be done to the US economy and global markets before the Fed changes tack and eases policy again? The “Fed Put” is the theme of this week’s MLIV Pulse survey.

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 4 p.m. New York time

- The Nasdaq 100 fell 0.3%

- The Dow Jones Industrial Average was little changed

- The MSCI World index fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.3% to $1.0556

- The British pound rose 0.2% to $1.2489

- The Japanese yen was little changed at 127.87 per dollar

Bonds

- The yield on 10-year Treasuries declined five basis points to 2.78%

- Germany’s 10-year yield was little changed at 0.94%

- Britain’s 10-year yield advanced three basis points to 1.89%

Commodities

- West Texas Intermediate crude rose 0.9% to $113.23 a barrel

- Gold futures were little changed

–With assistance from April Ma, Tassia Sipahutar, Michael Msika, Robert Brand and Isabelle Lee.