Taiwan’s ‘silicon shield’: Why island may not be the next Ukraine

The self-ruled island’s dominance in semiconductors is seen by some analysts as a deterrent against an invasion by Beijing.

Taipei, Taiwan – Since Russia invaded Ukraine, Taiwan’s security has been on the lips of policymakers and analysts the world over, amid predictions China could one day follow Moscow’s lead and attempt to take over the island nation.

Both Taiwan and Ukraine are young democracies, whose national identity and political independence face the threat of aggression from a neighbouring superpower.

Keep reading

list of 4 itemsRussia’s invasion of Ukraine: List of key events, day 37

The death penalty: Never justifiable, never acceptable

What you need to know about the Qatar World Cup draw

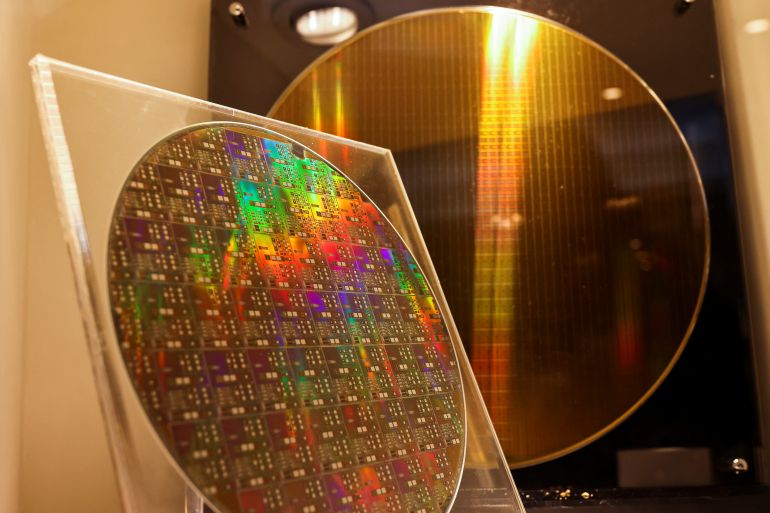

Taiwan, however, has a little-discussed secret weapon that Ukraine did not have – a dominance in manufacturing semiconductors that some analysts say could prove crucial in deterring an invasion by Beijing.

An invasion of Taiwan could trigger unprecedented global economic fallout due to the island’s position as arguably the most vulnerable single point of failure in the technology value chain.

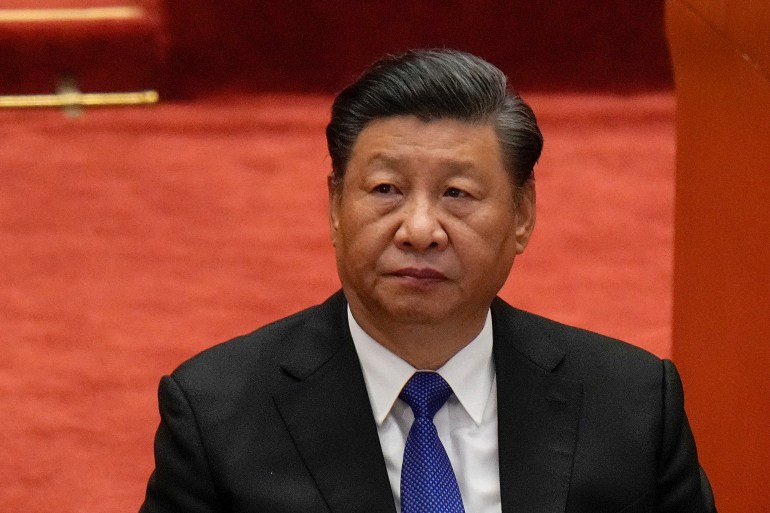

Taipei’s “silicon shield” makes the stakes especially high for China. While Chinese President Xi Jinping has pledged to reclaim the self-ruled island by force if necessary, Beijing relies heavily on Taiwanese technology to power key industries that it is banking on to double its gross domestic product (GDP) by 2035.

“Taiwan’s integrated deterrence strategy must keep this stark choice between national objectives for Beijing clear,” Jared McKinney, a scholar at Air University, told Al Jazeera. “Either conquer Taiwan or maintain economic prosperity.”

“A question delayed is an invasion denied,” McKinney said.

Taiwan accounts for 92 percent of global production for semiconductor process nodes below 10 nanometres (1 nanometre is one-billionth of a metre), making it the main supplier of the vast majority of chips that power the world’s most advanced machines, from Apple iPhones to F-35 fighter jets.

A one-year disruption to the Taiwanese chip supply alone would cost global tech companies roughly $600bn, according to a study by the Boston Consulting Group. In the event its manufacturing base was destroyed in a war, rebuilding production capacity elsewhere would take at least three years and $350bn, the study found.

“China is good at algorithms, software, and market solutions,” Ray Yang, a consulting director at Taiwan’s Industrial Technology Research Institute, told Al Jazeera. “But their industry needs many high-performance computer (HPC) chips that they do not have.”

“If a conflict interrupted their supply, it would dramatically slow down China’s AI and 6G ambitions,” Yang said. “They would have to reorder their entire industrial strategy.”

That dependence could be further exploited by Taipei to buttress its national security, according to some military analysts.

‘Warning signal Chinese policymakers can’t ignore’

McKinney, who stressed his views do not necessarily represent those of Air University or the US Air Force, said Taiwan’s “silicon shield” should be less a “commitment device” for American defence than a deterrent against Chinese aggression.

Last year McKinney and Peter Harris, an associate professor of political science at Colorado State University, published a paper on a “broken nest strategy” for deterring China. They proposed Taiwan could credibly threaten to destroy industry leader TSMC’s infrastructure at the onset of an invasion, which would deny Beijing access to its chips and inflict serious damage to its economy.

McKinney said deterrence could be boosted further by instituting a multilateral semiconductor sanctions regime whereby the United States, South Korea, and Japan joined with Taiwan to halt semiconductor exports to China if it started a war.

“If the ask is to sanction the whole Chinese economy, you might not get enough buy-in,” he said, expressing doubt that conglomerates with deep exposure to China’s market would pull out.

“The comparatively modest scope of semiconductor sanctions makes them more credible as a deterrent, making it a warning signal Chinese policymakers can’t ignore.”

Though China remains dependent on Taiwanese tech for now, it is working hard to turn the tables amid allegations of talent poaching and intellectual property theft. Taiwan bans Chinese-funded companies from investing in high-end technology and those who violate incoming “economic espionage” laws could spend up to 12 years behind bars. Last month, Taiwan raided eight Chinese tech companies and interrogated 60 Chinese scouts who were allegedly trying to poach Taiwan’s top engineers.

“The biggest threat to Taiwan’s continued technological dominance is talent poaching from mainland China,” James Lee, an expert on US-Taiwan relations who will take up an academic post with Taiwan’s Academia Sinica later this year, told Al Jazeera.

“So far, it [China] hasn’t succeeded for high-end chips … but it is plausible that they may succeed at some point, and given the sheer amount of resources that Beijing has at its disposal, Taiwan’s going to be under constant pressure.”

Ross Feingold, a Taipei-based lawyer, told Al Jazeera IP theft is a particular concern.

“Due to drawn-out court proceedings and slight penalties, the law does not inspire enough fear to deter individuals from routinely stealing trade secrets or insider information from firms,” Feingold said.

However, Yang does not see this as a big worry for leading firms like TSMC.

“They are very smart and have a very sophisticated system to protect their most sensitive information,” he said.

Taiwan’s tech dominance affects Washington’s risk calculus, too. The US has no defence treaty with Taiwan, while the debate is heating up in Washington over whether it should maintain its long-held policy of “strategic ambiguity” or switch to “strategic clarity”.

“I see US technological dependency on Taiwan as an effective – and even preferable – substitute to a policy of strategic clarity,” Lee said.

“It locks the United States into defending Taiwan to protect the island’s semiconductor industry, but it doesn’t mean that the United States is treating Taiwan as an ally or supporting Taiwan’s independence.”

Yet, with Washington investing $52bn into reshoring chip manufacturing and homegrown hero Intel edging to become the world’s most advanced chipmaker again, the US may not be technologically dependent on Taiwan for long.

“If the United States started manufacturing the world’s most advanced chips, that would make Taiwan less important to the United States and would consequently make the US less likely to defend Taiwan, but that is still very much a theoretical scenario,” Lee said.

“Intel might be able to reach this tier of elite manufacturers if there is substantial public and private investment in the United States over the course of the next 10-20 years, but even if that happens, it’s not likely to displace TSMC altogether.”

‘De-globalisation’

Even if Intel catches up technologically, there is no guarantee industry players will not still prefer TSMC.

“This is what Intel needs to deal with,” Yang said. “TSMC is fully trusted by its international partners since [unlike Intel] it does not have its own product and does not compete with them.”

“Global semiconductor making concentrated on the island thanks to three decades of globalisation that prioritised low costs and economies of scale. But now de-globalisation is very much under way as industrial and national leaders worldwide wake up to the reality of black swan events.”

Adjusting to the new reality of supply chain vulnerability, leading firms are moving process capacity outside of Taiwan. TSMC will kick-start the construction of semiconductor fabrication plants in Arizona and Japan’s Kumamoto in 2024. Taiwan’s UMC, the world’s third-largest chipmaker, is due to open a plant in Singapore the same year.

Yang believes international firms that previously saved by offshoring manufacturing will seek to offset the costs of reshoring through technical breakthroughs that will be achieved with the assistance of Taiwan.

“More and more players from up and down the supply chain are coming and setting up here to get closer to Taiwan’s ecosystem, be it Dutch lithographic equipment makers, Japanese chemical suppliers, and others,” he said.

“Taiwan will still lead the whole ecosystem because international players need to join with us to innovate the next generation of chips.”