Asian stocks rise as US bonds tumble on hawkish signals from Fed

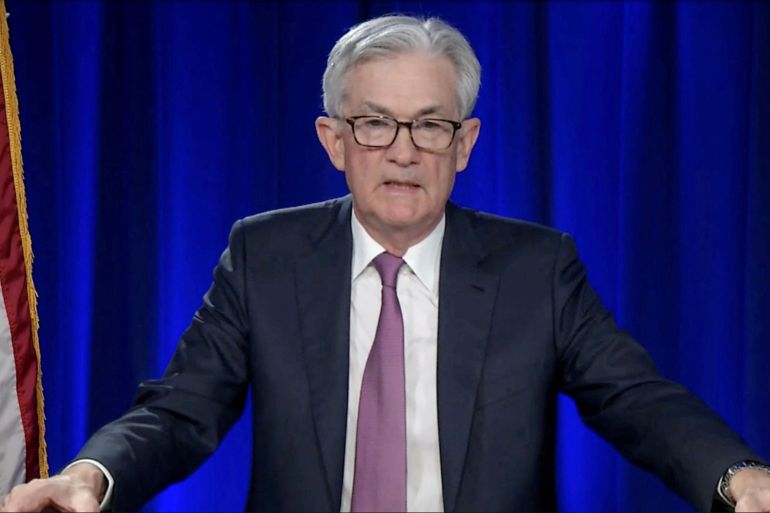

Bonds were under pressure Tuesday from Federal Reserve Chair Jerome Powell’s more hawkish tone on monetary policy. U.S. and European equity futures dipped, while Asian stocks pushed higher.

Treasuries extended Monday losses that included one of the biggest daily climbs in short-dated yields in the past decade. Australian and New Zealand debt slid. The gap between five-year and 30-year U.S. yields is around the least since 2007, signaling slower growth as the Fed hikes borrowing costs.

Keep reading

list of 4 itemsUkraine war exposes cracks in US ties to Middle East allies

Should Russian public figures take a stand on the Ukraine war?

Israeli PM, UAE de facto ruler hold talks with el-Sisi in Egypt

Stocks rose in Australia, South Korea and Japan, where a weaker yen may bolster the outlook for exporters. U.S. contracts fluctuated after Wall Street wobbled in the wake of Powell’s comments before closing little changed.

Powell said the Fed is prepared to raise interest rates by a half percentage-point at the next policy meeting if needed. It hiked by a quarter-point last week and signaled six more such moves this year. A dollar gauge advanced.

Oil extended a rally, with Russia’s war in Ukraine nearing the one-month mark and no conclusion in sight, exacerbating supply concerns over the loss of Russian crude. European Union countries are pushing for more sanctions on Russia, though some remain opposed to including oil in them.

The trajectory of bonds is a focal point for investors fretting about an economic slowdown. High inflation, stoked by commodity-market disruptions due to the war, has increased pressure on the Fed and some other key central banks to tighten monetary policy.

‘Reassuring for equity investors’

“If Powell is reinforcing that they are going to address inflation — that they’ve made mistakes, that their expectations of inflation were incorrect — just admitting that, and saying that we’re ready to do everything it takes, is definitely reassuring for equity investors,” Erin Gibbs, chief investment officer at Main Street Asset Management, said on Bloomberg Television.

Derivative traders Monday priced in about 7.5 quarter-point rate hikes at the remaining six Fed meetings this year, effectively making provision for more than one half-point rise.

“For the long term, 2.3% on the 10-year is not such a high figure at all,” Linda Duessel, senior equity strategist at Federated Hermes Inc., said on Bloomberg Television. “What spooks the market is when you have very quick moves, such as what we’re having now.”

Duessel said while Fed tightening might cause disruptions throughout the yield curve, the gap between the three-month and 10-year tenors is still steeply upward sloping, supporting the view that the U.S. economy remains strong.

While the Fed is tightening, expectations are growing that China will loosen monetary policy to support economic expansion.

China’s cabinet pledged stronger monetary-policy support while cautioning against flooding the market with liquidity, state broadcaster CCTV reported Monday. Authorities vowed to avoid measures that can hurt market sentiment.