Energy crunch: China mulls hiking power prices for factories

China’s government is considering hiking power prices for factories to ease a growing supply crunch, sources tell Bloomberg News.

The Chinese government is considering raising power prices for industrial consumers to help ease a growing supply crunch.

The rate hikes for factories could come in the form of higher flat fees, or in rates that are linked to the price of coal, according to people familiar with the details of the plan.

Keep reading

list of 4 itemsEnergy industry methane emissions rise close to record in 2023

What’s slowing down America’s clean energy transition? It’s not the cost

Global coal use to reach record high in 2023, energy agency says

The government has also discussed raising rates for residential users if the industrial increases aren’t enough to solve the crisis, said the people, who asked not to be identified because the information isn’t public. The plans may still be changed and are subject to final approval, the people said.

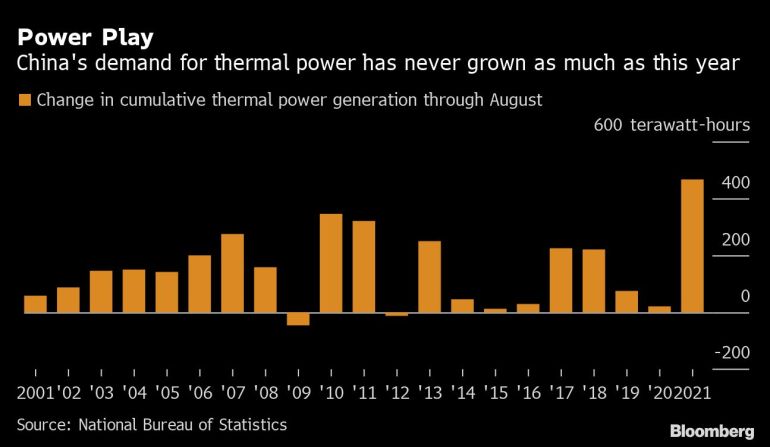

The discussions are coming as the world’s second-biggest economy faces power shortages that are threatening to slow growth and further strain global supply chains. Record-high coal prices mean many power generators are losing money at current electricity rates, keeping some from boosting generation to meet demand.

In its first high-profile public response to the power crunch that’s spread to at least 20 regions in China, the National Development and Reform Commission on Wednesday said it will let power prices reasonably reflect changes in demand, supply and costs.

However, most power in China is sold at regulated rates, which provinces are allowed to raise by as much as 10%, and it’s unclear if the NDRC is referring to the current limit or confirming rates will be allowed to go higher. Several provinces have already added the maximum 10%, so an additional hike would have to be more than that to have an effect.

The state economic planning agency also said the country will increase coal imports “moderately” and urged power plants to boost stockpiles before winter. It will also push major coal-consuming industries to save and control fuel use, and vowed to avoid abrupt power cuts for corporate users in northeast provinces.

Higher power prices could give generators reason to produce more electricity, while also incentivizing users to try to reduce consumption to lower their bills.

Shares of Chinese power producers surged on the news. Huadian Power International Corp. rose as much as 5% after earlier falling 1.7%. Datang International Power Generation Co. gained as much as 3.5% after having fallen by that much earlier.

To be sure, underpinning China’s power crisis is a shortage of coal, and generators burning more of it will only exacerbate the issue and add to greenhouse gas emissions. Higher power bills for factories could also add to inflationary fears in the country.

Hunan’s Provincial Development and Reform Commission is planning to unveil a trial program in October that would link industrial power prices to the coal market, China Business News reported.

(Adds more details from the 5th paragraph.)