Japan economy shrinks in first quarter – but less than expected

Economy contracted 3.9 percent, with the virus impacting personal consumption, posing the first fall in three quarters.

Japan’s economy shrank at a slower-than-initially reported pace in the first quarter, on smaller cuts to plant and equipment spending but the coronavirus pandemic still dealt a huge blow to overall demand.

Separate data showed growth in bank lending slowed sharply in May, while real wages posted the biggest monthly jump in more than 10 years in April, in signs that the world’s third-largest economy was gradually overcoming last year’s pandemic hit.

Keep reading

list of 4 itemsUS warns against travel to Japan as country grapples COVID surge

Japan mulls cheer-free Olympics in new COVID fan rules: Report

Japan to donate additional $800m to WHO’s COVAX body: Report

Among the mixed indicators are some reassuring signs for policymakers, who are worried Japan’s recovery will lag behind chief economies that have rolled out COVID-19 vaccines much quicker and are able to reopen faster.

The revised gross domestic product (GDP) decline was mainly due to a smaller fall in public and capital spending, which both eased less than initially thought, offsetting a slightly larger fall in private consumption.

The economy retreated by an annualised 3.9 percent in January-March, not as bad as the preliminary reading of an annualised 5.1 percent contraction but still posting the first fall in three quarters, Cabinet Office data showed on Tuesday.

The reading, which beat economists’ forecast for a 4.8 percent decline, equals a real quarter-on-quarter contraction of 1 percent from the prior quarter, versus a preliminary 1.3 percent drop.

“Overall, capital spending and private consumption remained weak, which showed weakness in domestic demand,” said Takeshi Minami, the chief economist at Norinchukin Research Institute. “The vaccine issue is the most important thing for the (economic) recovery,” he said, adding that the vaccination rate would need to come to about 50 percent to boost the country’s economic recovery prospects.

With Japan’s latest virus emergency set to last through mid-June, about a month before the planned start of the Tokyo Olympics, economists were looking to the GDP report for any signs of extra weakness that would indicate a heightened risk of another contraction this quarter. They did not get that.

“When you see the outlook for the economy, it’s not all bad,” said economist Yoshiki Shinke at Dai-Ichi Life Research Institute. “The pace of vaccination is picking up faster than expected and that’s increasing a chance of robust rebound from the third quarter.”

Pent-up demand

Capital spending shrank 1.2 percent from the prior quarter, better than a preliminary 1.4 percent decrease and matching the median forecast for a 1.2 percent loss. Government consumption fell 1.1 percent, a smaller drop than a preliminary 1.8 percent decline.

Private consumption, which makes up more than half of GDP, dropped 1.5 percent from the previous three months, worse than the initial estimate of a 1.4 percent drop.

However, Economy Minister Yasutoshi Nishimura said spending could recover as consumers return to the streets.

“If infections subside, there’ll be pent-up demand from not having been able to go eating out or travelling,” Nishimura told reporters after the release of the data.

COVID-19 surge

Net exports – or exports minus imports – subtracted 0.2 percentage point from growth, while the hit to domestic demand pulled it down by 0.8 percentage point, not as bad as a preliminary contribution of minus 1.1 percentage point.

The better-than-expected revision comes after household spending and exports jumped in April, although the gains were inflated largely by the comparison to last year’s deep pandemic-driven plunge.

Total lending by Japan’s banks grew 2.9 percent in May from a year earlier, slowing at a record pace from a 4.8 percent increase in April, Bank of Japan data showed on Tuesday.

Inflation-adjusted wages, a barometer of household purchasing power, rose 2.1 percent in April on a year-on-year basis, the government said.

The bank’s lending slowdown was due largely to the base effect of a COVID-19-driven surge last year, while a drop in consumer prices and rebounds in overtime pay and compensation for part-time workers helped lift wages.

The government has come under political pressure to water down an already stretched fiscal target this year as the cost to combat the health crisis accumulates.

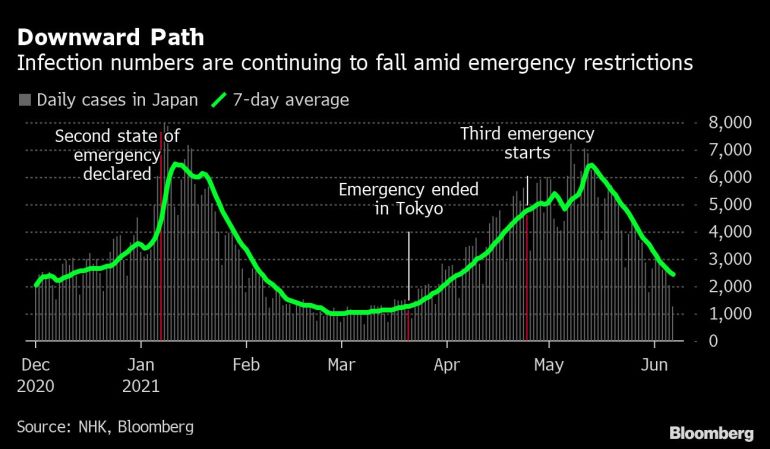

Since the start of the year, Japan’s recovery has been put on pause by on-again-off-again declarations of emergency to try to contain virus flareups.

Prime Minister Yoshihide Suga’s administration has walked a tightrope, using narrowly selected restrictions on restaurants and bars to quell recent outbreaks but letting most other businesses carry on as normal.

That approach has kept the economy from collapsing like it did last year, but it has also failed to stamp out the virus. Meanwhile, a vaccine drive that did not kick into high gear until recent weeks allowed the crisis to drag on, even if case numbers are still far below US or European levels.

Some analysts expect Japan’s economy to post another contraction in the current quarter – pushing it back into a technical recession – as an extension of coronavirus emergency curbs for Tokyo and other main areas hurts domestic demand.