Sit back and enjoy the show! AMC soars past $14B market value

The United States movie theatre company’s stock is up more than 1,250 percent year-to-date, fuelled by retail investors and Reddit users.

AMC Entertainment Holdings Inc.’s eager retail investors have vaulted the company’s market value to $14 billion for the first time.

Shares extended an intraday rally to soar 49%, the most since late January, at 3:15 p.m. in New York, as the Leawood, Kansas-based company’s value jumped to a record. Volume also jumped, with more than 600 million shares changing hands, more than four-times the average of the past five sessions.

Keep reading

list of 4 itemsGame over: GameStop CEO heading for the exits

GameStop plans $1bn share sale after Reddit-fuelled rally

Shares of Reddit favourite GameStop fall as it mulls stock sale

AMC’s revival has been fueled by individual investors eager to save the movie theater industry after it raised more than $1 billion in financing to avoid bankruptcy over recent months. The stock is up more than 1250% year-to-date.

Chief Executive Officer Adam Aron has embraced the Reddit-fueled rally and talked to new retail investors on conference calls. The stock has more than doubled since AMC reported quarterly results on May 6, adding more than $10 billion in value. Thursday’s milestone stands out against a market value bottom of $216.8 million which was hit in April 2020.

While Chad Beynon, an analyst with Macquarie Securities, is waiting for AMC to continue to shed debt and lease obligations before getting more constructive on shares, he acknowledged the mania individual investors can create.

“The Reddit crowd is strong, the volumes have been off the charts lately, so there’s clearly demand that wasn’t there pre-Covid,” he said by phone. The company’s ability to raise cash at over $10 a share earlier in the month “marked the first time the company was able to financially benefit from the Reddit rally,” he said.

The cash AMC has raised through the sales of hundreds of millions of additional shares is a key driver for the massive run-up in market value despite the stock actually trading down 20% from a 2015 peak. More than 490 million shares of AMC are currently available for trading, data compiled by Bloomberg show, almost ten-times the 52 million shares outstanding at the start of last year.

More Capital

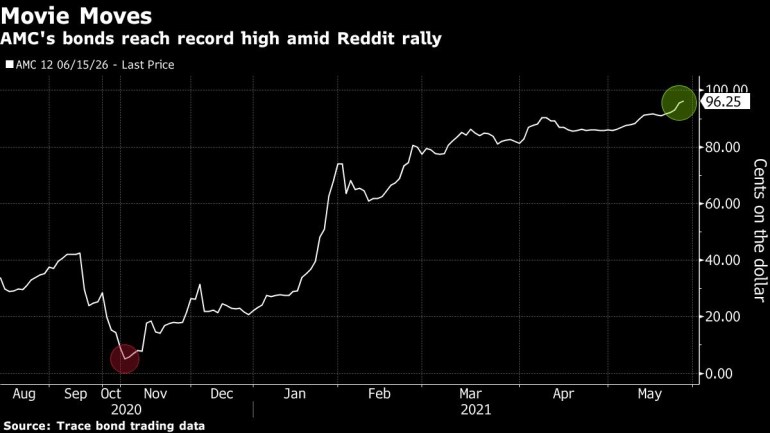

Debt tied to AMC has rallied alongside shares, setting new highs in recent days. The company’s bonds, which were trading at a low of 5 cents in November, are inching close to par, according to Trace trading data. That debt carries a hefty coupon of 12% for the notes due 2026.

AMC’s bonds were among the top performers in the U.S. high-yield market on Thursday, extending gains from earlier in the week.

The company said previously it might seek more financing, and some investors have suggested it sell more shares to pay down or look to refinance its more than $10 billion debt load.

The cinema chain “will carefully examine the raising of additional capital in whatever form we think is most attractive” and is focused on de-leveraging, Aron said on a call to discuss fourth-quarter results in March.

The company’s latest resurgence at the hands of individual investors has pushed the market value to more than double its April 2017 peak of $4.17 billion prior to this year’s trading. Put a different way, AMC has consistently added more than $1 billion in each of the last three sessions — more than double its value at the start of the year.

The movie theater company’s ability to post strong box office numbers as it reopens in key markets like New York and California will be important, B. Riley Securities analyst Eric Wold said by phone. Wold downgraded shares to neutral from buy on Wednesday citing valuation concerns.