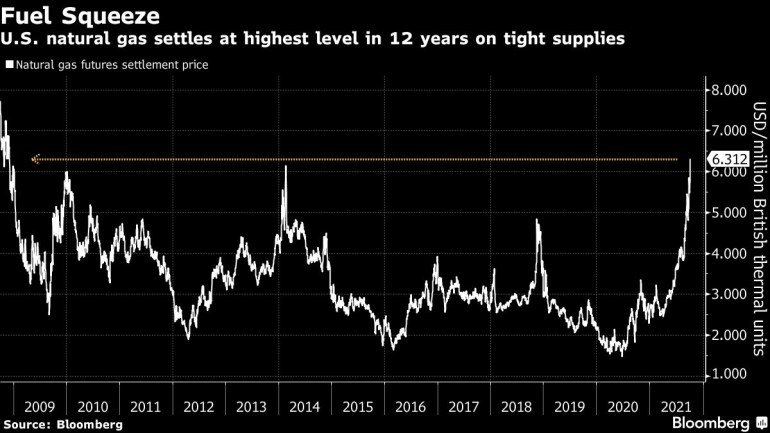

US natural gas prices jump 9.5 percent to highest since 2008

Gas futures settled at $6.312 per million British thermal units on the New York Mercantile Exchange.

Natural gas futures jumped to the highest settlement price in 12 years in New York as global gas supply shortages stoke concerns for U.S. shortages.

As the northern hemisphere heads into winter-heating season, low U.S. auxiliary supplies have sparked concerns about potential shortages as demand for the furnace fuel ramps up. Gas futures rose 9.5% to close settle at $6.312 per million British thermal units on the New York Mercantile Exchange, the highest close since December 2008.

Keep reading

list of 4 itemsUS oil hits highest since 2014 as OPEC+ sticks to existing output

Saudi sees fuller state coffers next year on surging oil prices

OPEC says oil will remain number one, despite green energy push

Traders and brokers are “definitely considering that there’s a high potential for the market to have to move into what we would call gas-rationing pricing which simply is that you basically have to preserve gas in your inventories to meet deliverability needs,” said Nina Fahy, head of North American natural gas analysis at research firm Energy Aspects Ltd. Many are bracing for a brutally cold winter to deplete U.S. supply, despite mild weather forecasts for the winter season.

The Bloomberg Commodity Spot Index soared to an all-time high on Monday as a global resurgence in demand for raw materials collides with supply constraints. The squeeze has been even more acute in Europe and Asia, where prices for gas and power soared to new all-time highs. In the U.K., benchmark gas prices reached a fresh record Tuesday, jumping 23% to the equivalent of about $42.

Gas production in U.S. fields, excluding Alaska, foundered around 91.2 billion cubic feet on Tuesday, the lowest since the beginning of September, according to BloombergNEF. Nationwide inventories held in storage to augment pipelined supplies during winter are 15% lower than a year ago, government figures showed.