Buy now! COVID-19 sparks Southeast Asian e-commerce boom

Many consumers in region used mobile shopping for first time this year as lockdowns hammered spending on trips: Survey.

Southeast Asia’s sizzling-hot internet economy cooled during the pandemic but spending online should bounce back rapidly and triple to more than $300 billion by 2025, research from Google, Temasek Holdings Pte and Bain & Co. shows.

The value of transactions in four key areas — e-commerce, travel, media and transport and food — should grow just $5 billion to about $105 billion in 2020, when many consumers turned to mobile shopping for the first time but lockdowns hammered spending on trips.

Keep reading

list of 4 itemsMalaysia budget: Government plans to maintain fiscal stimulus

Booster shot: Asian shares extend rally on vaccine hopes

‘Oppressive and dangerous’: Amazon workers take company to court

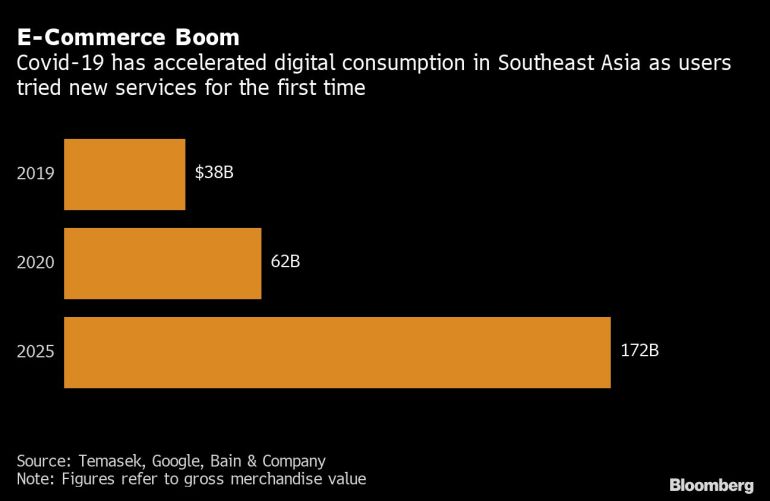

The region, home to Alibaba Group Holding Ltd.’s Lazada and Tencent Holdings Ltd.-backed Sea Ltd., will see a 63% increase in e-commerce gross merchandise value from 2019 as home-bound consumers picked up groceries and essentials from the likes of Lazada’s RedMart and Sea’s Shopee. Online shopping is now forecast to hit $172 billion by 2025 versus a previous $153 billion estimate, the research showed.

It’s “a clear indication that momentum has not been derailed by the year’s challenging environment,” according to the study, a closely watched annual review that covers six countries and serves as a benchmark for the region’s fast-growing internet industry.

![Southeast Asia online spending [Bloomberg]](/wp-content/uploads/2020/11/365885336.jpg?w=770&resize=770%2C449)

Unsurprisingly, online travel was the worst-hit. The value of business transactions plunged 58% to just $14 billion this year. Still, the industry’s eventual recovery could boost the market to $60 billion by 2025, the study showed. Transport and food delivery — a sector dominated by car-hailing leaders Grab Holdings Inc. and Gojek — also took a hit, dropping 11% to $11 billion in 2020.

Demand for ride-hailing services collapsed globally, prompting the region’s two most valuable startups to cut jobs.

Overall, this year’s “seismic” shifts in consumer behavior have advanced the internet sector, the report said. Southeast Asia added 40 million new internet users in 2020, while one in three digital service users came online for the first time due to Covid-19.

E-commerce is driving growth in Indonesia, despite the devastating impact the pandemic has had on its overall economy. Southeast Asia’s largest economy fell into its first recession since the Asian financial crisis more than two decades ago in the third quarter. But Google, Temasek and Bain expect Indonesia’s digital economy to almost triple to $124 billion by 2025, though down from a previous estimate of $133 billion.

![Southeast Asia digital economy size [Bloomberg]](/wp-content/uploads/2020/11/365887283.jpg?w=770&resize=770%2C580)

The pandemic has also accelerated adoption of online financial services as more consumers rely on contactless ways to pay and transfer money, shunning cash. Digital lending, however, stood unchanged from last year at $23 billion, reflecting concerns over non-performing loans.

“Untested peer-to-peer lenders targeting riskier payday loans and some smaller traditional lenders will face difficulties in the coming quarters,” the report said.

![Southeast Asia payment modes [Bloomberg]](/wp-content/uploads/2020/11/365910723.jpg?w=770&resize=770%2C587)

Tech investment in Southeast Asia has declined since 2018, primarily driven by a slowdown in big-ticket unicorn funding. The region’s tech companies raised $6.3 billion in the first six months of this year, down from $7.7 billion a year earlier. Non-unicorn investments are on the rise, the study showed.

![Southeast Asia deal values [Bloomberg]](/wp-content/uploads/2020/11/365910089.jpg?w=770&resize=770%2C523)