US markets rise even as millions of people in US remain jobless

Consumer behaviour is being reshaped by the coronavirus and efforts to mitigate its spread.

Despite high unemployment in the United States, upbeat tech earnings and hopeful signs that a greater portion of the US economy will soon open boosted US markets on Thursday.

The Dow Jones Industrial Average rose 0.89 percent to end the day at 23,875.89. The S&P 500, a widely used gauge of US retirement and education savings accounts, gained 1.15 percent. The tech-heavy Nasdaq Composite Index added 1.41 percent.

Keep reading

list of 1 itemThe Nasdaq moved into the positive for 2020 after dipping well over 20 percent for the year as of late March. The S&P 500 remains down over 10 percent this year. The difference between the two indices speaks to how consumer behaviour is being reshaped by the coronavirus and efforts to mitigate its spread.

The coronavirus is slowing the growth of ride-hailing companies as stay-at-home restrictions kept many people from travelling or commuting to work. Shares of Uber ended the trading session 11.2 percent higher, but started to decline in after-hours trading. The ride-hailing service reported a higher-than-expected adjusted loss of $1.70 a share on revenue of $3.5bn.

Uber said bookings from ride-hailing riders fell during the quarter for the first time in its history. Lyft shares end up 21.7 percent.

Meanwhile, decreased in-person shopping boosted the value of online-payment solution PayPal Holdings. Its shares rose 14 percent. The company says it expects payment volumes to increase in the second quarter as more people shop online.

Stocks have rebounded sharply since late March from the coronavirus-fuelled selloff, helped by massive monetary and fiscal stimulus. Investors are now watching efforts by a number of states to spark their economies by easing restrictions put in place to fight the outbreak.

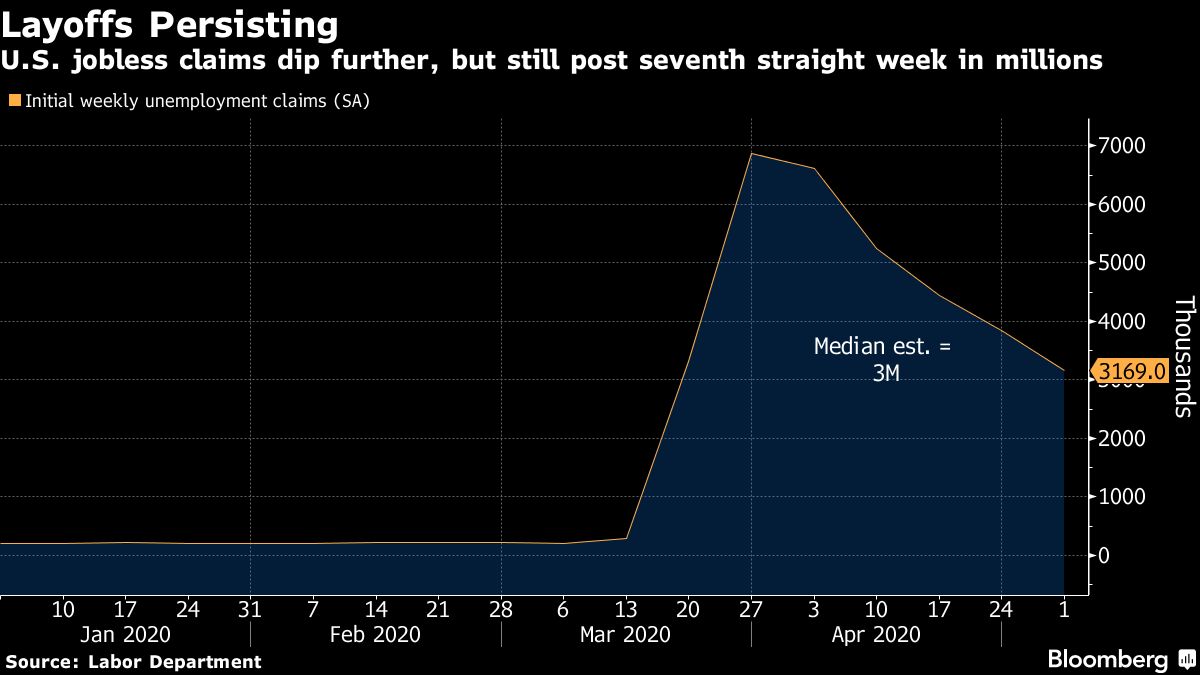

Still, jobless data is weighing on the minds of most investors. Millions more Americans filed for unemployment benefits last week. The data suggests layoffs are spreading from consumer-facing industries to other segments of the economy, which may hold back growth.

The US employment report for April is due on Friday.

Rising unemployment is impacting consumer spending and credit.

US consumer credit fell $12bn, the largest drop since 2015.

“While larger than expected, the decline in revolving credit was not surprising, given the sharp pullback in consumer spending in March. We expect further declines in revolving credit in the months ahead as consumer spending continues to decline,” Nancy Vanden Houten, CFA lead economist at Oxford Economics, wrote in a research note.

Investors were also encouraged by news that China’s exports unexpectedly rose in April for the first time this year as factories raced to make up for lost sales due to the coronavirus pandemic.

Wall Street is closely watching the development of treatments for the coronavirus. Moderna Inc shares rose 8.7 percent after the company sped up plans for its experimental COVID-19 vaccine and said it expected to start a late-stage trial in early summer.

“The market rightly or wrongly is just much more focused on what that data looks like two months from now, not what that data looks like right now,” said Eric Freedman, chief investment officer at US Bank Wealth Management.