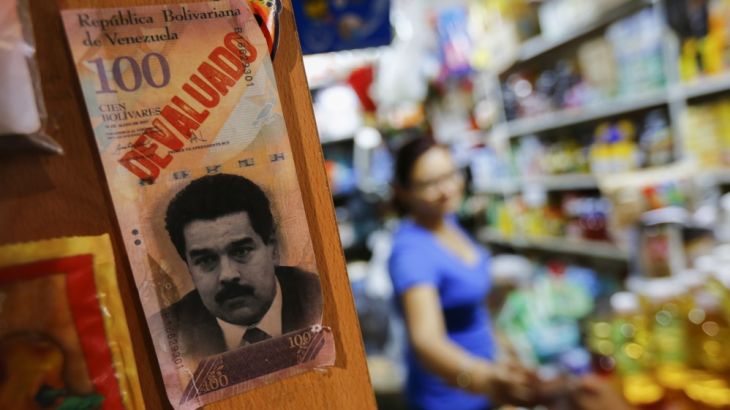

Venezuela: The world’s worst-performing economy

We look at hyperinflation, food shortages and negative growth and ask whether anything can be done to save the economy.

With hyperinflation so severe that people have to carry backpacks stuffed with cash to the local supermarket, it’s no surprise that Venezuela – a country which is in its worst shape since World War II – is the world’s worst-performing economy.

Across the oil-rich South American country, chronic power outages, crumbling infrastructure and severe shortages of basic goods have led the army and police to guard food supplies.

Keep reading

list of 4 itemsBehind India’s Manipur conflict: A tale of drugs, armed groups and politics

China’s economy beats expectations, growing 5.3 percent in first quarter

Inside the pressures facing Quebec’s billion-dollar maple syrup industry

Less than three years after the death of the charismatic and larger-than-life Hugo Chavez, the hugely popular leader’s Bolivarian Revolution is being blamed for failing Venezuela.

But how did the country get itself into this mess?

With oil accounting for 95 percent of Venezuela’s export earnings, plummeting world prices have sent the economy reeling towards collapse.

Home to the world’s largest inflation rate, the IMF expects inflation to blow past 700 percent this year. And just last week, President Nicolas Maduro, Chavez’s successor, was forced to make the controversial decision of raising fuel prices – by a whopping 6,000 percent.

And with fears growing that Venezuela won’t be able to afford its debt repayments, the situation could get even worse.

Patrick Duddy, the director of the Center for Latin American and Caribbean Studies at Duke University and a former US ambassador to Venezuela joins Counting the Cost to discuss how Venezuela fell into this extraordinary mess.

Nigeria’s changing fortunes

Nigeria is struggling to leverage the country’s vast oil wealth with low oil prices taking a heavy toll on its finances.

The world’s eighth-largest oil exporter with almost 90 percent of its export earnings tied to oil, President Muhammadu Buhari has faced a tough first year in office.

Since entering office in April, Buhari has seen Nigeria’s total debt rise to $65.4bn, the currency collapse to record lows, and inflation rise to 9.6 percent – the highest level since 2012.

Dr Amy Jadesimi, the managing director of the Nigerian oil services group LADOL, discusses Nigeria’s lack of diversification and high dependence on crude oil.