UAE pledges $3bn loan to help cash-strapped ally Pakistan

The existing loan of $2bn will be topped with an additional loan of $1bn, a statement by the Pakistani prime minister’s office says.

The United Arab Emirates is pledging a $1bn loan to cash-strapped Pakistan and also agreed to roll over an existing loan of $2bn in a boost to the South Asian nation grappling with an economic crisis, according to Pakistan prime minister’s office.

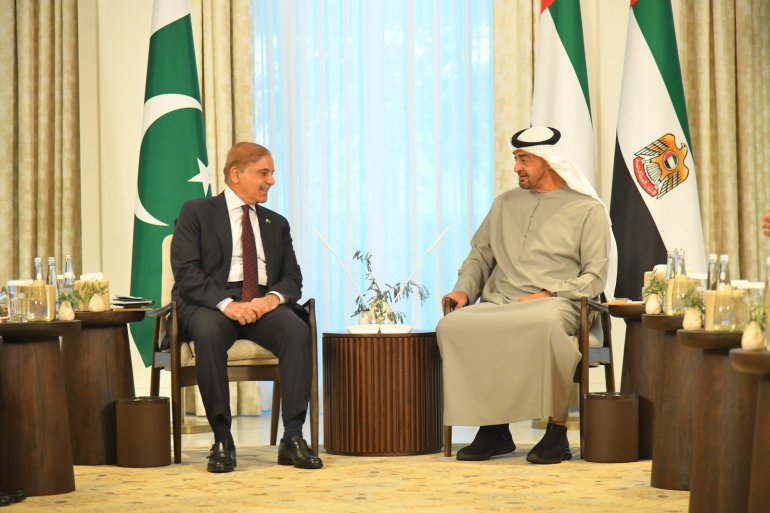

The announcement came after Pakistani Prime Minister Shehbaz Sharif held talks with UAE President Sheikh Mohamed bin Zayed Al Nahyan in the capital Abu Dhabi on Thursday on his third visit to the Gulf country after taking office last April.

Keep reading

list of 3 itemsPakistan’s army chief visits Saudi Arabia amid economic crisis

Pakistan Taliban threatens top political leadership including PM

The two leaders “agreed to deepen the investment cooperation, stimulate partnerships and enable investment integration opportunities between the two countries,” a PMO statement said.

Sharif has been struggling to put the economy on track since taking office, with his first finance minister Miftah Ismail resigning abruptly last September.

Islamabad is seeking financial aid from its close allies such as Saudi Arabia and China, besides the UAE as it negotiates for the next tranche of loans from the International Monetary Fund (IMF).

Ismail told Al Jazeera that the decision to roll over the fund is “great news to Pakistan”, and the announcement was seen by some analysts as a much-needed relief to the country which has seen its central bank’s foreign reserves deplete to less than $4.5bn, covering less than a month of imports.

‘Precarious economy’

Ammar Habib Khan, an Islamabad-based economist, said that the additional funding would provide timely support to Pakistan’s precarious economy.

On Wednesday, the World Bank slashed the gross domestic product (GDP) growth projections to 2 percent. The dire economic situation has forced the government to resort to extreme steps, such as closing malls and restaurants early.

“This funding will provide some support to Pakistan to manage its imports. However, to get out of the crisis, it does need more injection of dollars, necessitating continuation of the International Monetary Fund programme,” he told Al Jazeera.

Pakistan has struggled to convince the IMF to release the next tranche of $1.1bn loans, which has been pending since September on account of deadlock between the two parties.

The funding was dependent upon the country agreeing to the lender’s various conditions, such as increasing energy prices and expanding the tax base. Pakistan entered an IMF programme in 2019 and the last tranche of the fund worth $1.17bn was delivered in August last year.

Some experts warned against donor fatigue of Pakistan’s reliance on bilateral funds.

“It is like giving money to a drug addict who promises to mend his ways but comes back asking for more money,” Asad Sayeed, an economist based in the port city of Karachi, told Al Jazeera.

Saudi Arabia deposited $3bn in Pakistan Central Bank in October and there are reports that Saudi Crown Prince Mohammed bin Salman has asked Saudi Fund for Development to look into increasing the deposit by another $2bn.

China remains Pakistan’s biggest lender at $30bn – one-third of its foreign debt.

‘No option but to accept the IMF programme’

Sayeed, who works for the research firm Collective for Social Science Research, said that Pakistan does not have many choices left and has no options but to accept the IMF programme.

Pakistan must make more than $20bn payments in debt obligation in the next 12 months, according to the central bank’s data. A deal with IMF may help unlock more bilateral assistance.

Not entering the global lender’s programme, Sayeed said, is going to create a situation with “unimaginable consequences”.

One of the risks was default, which would crash the economy.

“The authorities must ask themselves if they’d prefer to have a massive surge of inflation hit the population, or they want to find themselves a situation where the country does not have any fuel or pulses or all the things that we import. Ours is an import-dependent economy and running out of dollars would lead to an unprecedented situation for us,” he warned.

Pakistan’s government has been reluctant to accept the IMF programme because of the harsh conditions, which included slashing of subsidies, which could further push inflation up.

Government data indicated that Pakistan’s import bill for the last six months of the year 2022 was more than $30bn, of which, more than $5bn was for petroleum products.

Pakistan has already been struggling with the aftermath of devastating floods last year that killed 1,700 people and led to the loss of billions of dollars.

The country was able to secure more than $10bn in an international donors’ conference in Geneva last week to rebuild the country ravaged by the floods, most of which was in the form of loans.

Sharif invited the UAE president to visit Pakistan on a state visit which was accepted.

The Pakistani prime minister was scheduled to meet UAE Prime Minister and the ruler of Dubai Sheikh Mohammed bin Rashid Al Maktoum.

He was also expected to hold meetings with Emirati businessmen and investors to discuss ways to enhance bilateral trade between Pakistan and the UAE.

Pakistan’s new army chief, General Syed Asim Munir, also met UAE President Al Nayhan two days ago as part of his one-week trip that also included close ally Saudi Arabia.