Egyptian pound drops as Ukraine war prompts dollar flight

Egypt’s pound depreciated by almost 14 percent while its central bank raised interest rates, citing the war in Ukraine.

Egypt’s pound has depreciated by almost 14 percent after weeks of pressure on the currency as foreign investors pulled out billions of dollars from Egyptian treasury markets following Russia’s invasion of Ukraine.

The pound dropped to 18.17-18.27 against the dollar on Monday, Refinitiv data showed, after having traded at approximately 15.7 pounds to the dollar since November 2020. That is likely to have a heavy toll on poor and middle-class Egyptians.

Keep reading

list of 3 itemsEgypt is ‘a terror state’, says freed human rights activist

How a viral dance video fuelled women’s rights debate in Egypt

The central bank also increased overnight interest rates by 100 basis points in a surprise monetary policy meeting, citing the invasion and the coronavirus pandemic – which drove oil prices to new records.

The central bank cited global inflationary pressures amplified by the war in Ukraine for its rise in rates, which lifted the overnight lending rate to 10.25 percent and its overnight deposit rate to 9.25 percent.

Egypt has been in discussions with the International Monetary Fund about possible assistance, people close to the negotiations have said, but it has not announced any formal request.

“This is a good move to make as the devaluation of the pound moves it roughly in line with its fair value and it could pave the way for a new IMF deal,” said James Swanston of Capital Economics.

“However, it will be key whether policymakers now allow the pound to float more freely or continue to manage it and allow external imbalances to build up once more, possibly resulting in future step devaluations like today’s in the future.”

Swanston also said the increases in interest rates and a devaluation of the Egyptian pound “could be precursors” to securing a new financing package from the IMF.

“Fresh financial assistance from the IMF would certainly help to reassure investors over Egypt’s commitment to orthodox macroeconomic policymaking,” he said.

The IMF made no immediate comment.

Monday’s weakening of the pound could catalyse inflows of foreign currency, while investors who already had money in Egyptian treasuries would be unlikely to sell now, said Farouk Soussa, senior economist at Goldman Sachs.

“The move is designed to trap liquidity in the market and bring in investors who might be sitting on the sidelines waiting for the pound to bottom out,” he said.

But it would also likely add to inflation and possible local dollarisation.

“The big question is whether this is enough, or if more might be needed to entice portfolio investors,” Soussa said.

Higher wheat prices

Meanwhile, headline inflation has accelerated to its highest level in nearly three years, registering 8.8 percent last month and touching the upper limit of the central bank’s 5-9 percent target range.

According to a study last week by the International Food Policy Research Institute, higher wheat prices could nearly double annual state spending on wheat imports to $5.7bn, straining government finances and fuelling inflation pressure.

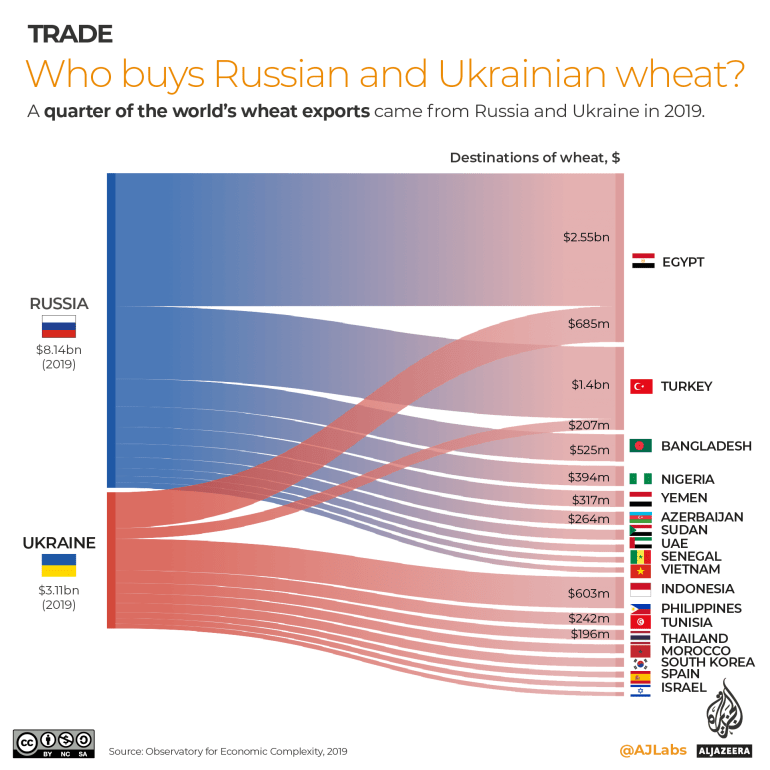

Egypt is the world’s largest importer of wheat, mainly from Russia and Ukraine, which together account for nearly a third of the world’s wheat and barley exports.

Prime Minister Moustafa Madbouly set the price of unsubsidised bread on Monday at 11.5 Egyptian pounds ($0.66) per kilogramme, according to a statement from his office. Prices had jumped as much as 25 percent because of disruption to wheat imports caused by Russia’s offensive in Ukraine.

Ukraine is also is a major supplier of corn and the global leader in sunflower oil, used in food processing. Russia and Ukraine are also significant sources of visitors to Egypt, where tourism is a main source of foreign currency.

Credit rating agency Fitch said last week that the war in Ukraine would add to Egypt’s economic strains, including “reduced tourism inflows, higher food prices and greater financing challenges”.