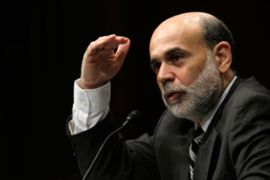

US cuts rates in bid to stem crisis

Federal Reserve head cuts interest rate in bid to spur spending and limit recession.

Cut ‘priced in’

The rate has not been lower since 1958, when Dwight Eisenhower was the US president.

In New York, the Dow Jones industrial average of leading shares dropped in the minutes before the close of trading after earlier shooting higher.

The Dow ended down 74.16 points, or 0.82 percent, at 8,990.96.

Joe Saluzzi, a trading manager in New Jersey, US, told the AFP news agency: “I guess the market priced in a 50 basis-point cut.

“You’re getting to a level of how much more can they cut and is this doing really anything? “

Some traders had speculated that the cut in interest rates was going to be even deeper.

Global gains

Britain’s top share index earlier closed 8.1 per cent higher in expectation of the US rate cut.

The benchmark FTSE 100 ended 316.16 points higher to close at 4,242.54, after rising nearly two per cent on Tuesday, up 9.3 per cent on the week and heading for its biggest weekly gain since 2001.

France’s CAC-40 closed 287.65 points, or 9.2 per cent higher, at 3,402.57.

Germany’s DAX was slightly lower following a 40 per cent slump in Volkswagen AG shares.

Shares in Japan ended the day up almost eight per cent, continuing a winning streak buoyed by a strengthening dollar against the yen and Tuesday’s 11 per cent surge in stocks on Wall Street.

Wednesday’s close saw the benchmark Nikkei index up 7.7 per cent after a zigzag day of trading, taking the index back above the psychologically important 8,000 points mark for the first time in a week.

Reports that the Bank of Japan will announce a rate cut later this week added to the buying mood among Japanese investors.

Japanese interest rates are already low by the rest of the world’s standards at just 0.5 per cent.