IMF addresses voting imbalance

International Monetary Fund directors have agreed to give more influence to developing countries, including China, reflecting the shifting balance of power in the global economy.

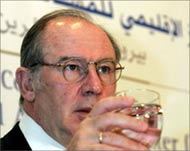

Rodrigo Rato, managing director of the International Monetary Fund (IMF), said that under the plan, China, South Korea, Turkey and Mexico will see immediate increases in their voting rights as part of a two-year reform programme.

The 184-member fund was set up after the second world war and lends money to countries in economic difficulty. It is dominated by the United States, European countries and Japan.

Despite its growing economy, China has less voting power than Belgium and the Netherlands combined.

“I think that all members recognise that relevant quotas and voting shares do not adequately respond to the reality of the world economy,” Rato said late on Thursday.

Sister organisation

Along with its sister institution, the World Bank, the IMF has been criticised in countries such as Argentina and in Southeast Asia and Africa for prescribing severe belt-tightening measures.

|

|

Rodrigo Rato: A new quota |

Rato said there was an agreement that a new formula for quotas should be based on the size of a country’s economy and its openness, but the exact parameters had not yet been decided.

The quotas determine how much a member contributes to the fund, its voting rights and access to financing, which currently totals $28 billion in loans outstanding to 74 countries.

At the same time Rato said it was important to protect the representation of lower-income countries through an increase in the number of votes a member is allocated regardless of their economic clout.

African concerns

African countries are worried that, with the focus on fast-growing economies, they could miss out on a chance to get a greater say at the IMF.

The plan, approved by the 24 directors late on Thursday, will be submitted to the governors from each member country and is expected to be given final approval at the fund’s annual meeting on September 19-20 in Singapore.

Some US critics oppose any increase of China‘s influence unless the country takes steps to revalue its currency. The yuan’s relatively cheap value has encouraged Chinese exports.

The US government sees reform of the IMF as central to its goal of redressing global economic imbalances, which have frequently been cited by Rato as one of the biggest menaces to world growth.

“The United States has expressed clearly that they are backing the reform package,” Rato said.

He called on China to allow market forces to determine the value of its currency, but declined to link the issue to IMF reform.

Spanish economist

Rato, a former Spanish economy minister, had said he expects reform to have little impact on policy decisions.

The fund is also looking to step up its financial surveillance role through multilateral consultations and other measures.

Sadakazu Tanigaki, the Japanese finance minister, welcomed the IMF board’s decision, saying his government would work with other nations on increases to fund quotas. Tokyo has often supported fund reform.