Oil prices rise above $55

As oil prices push above $55 a barrel for the first time, analysts are speculating about the resilience of world stock markets.

Nigel Cobby, director of European equities at JP Morgan said the stock market was not going down very much, “which maybe suggest how much it could go up if we had some good news on the oil price”.

“It’s not so much how high the oil price goes, it’s a question of how long it stays at a higher level,” he said.

“The longer it stays at these levels then clearly the bigger, negative impact it’s going to have on the economy.”

JP Morgan downgraded its 2005 global economic growth forecast on Monday to 3.1% from 3.8% previously.

“In our opinion it [the oil price] is probably the single biggest factor that is stopping this market going up,” he added.

European stock markets eased back slightly in early trading on Monday.

The London FTSE 100 index dropped 0.19% to 4613.70 points, the Frankfurt DAX 30 lost 0.48% to 3903.21 points and the Paris CAC 40 fell 0.40% to 3656.21.

1970’s oil shock

In Tokyo, the Nikkei-225 share index closed 0.16% lower on Monday, extending losses for a seventh consecutive session.

US share prices skidded lower last week as surging oil prices and uncertainty about the presidential election kept the mood cautious.

The Dow Jones Industrial Average dropped 1.21% for the week ending Friday at 9933.38, while the Standard and Poor’s 500 broad-market index retreated 1.24% to 1108.20.

|

|

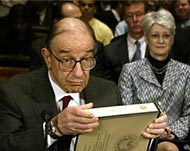

Greenspan says oil prices are not |

But prices perked up on Friday after Federal Reserve chairman Alan Greenspan said soaring oil prices should inflict less damage on US economic growth and inflation than during the 1970’s oil shock.

However, the harm could intensify if oil prices moved “materially higher”, he warned.

Record high prices were set to have only a limited impact on economic recovery in the 12-country Eurozone, a top official of the European Central Bank said in a newspaper interview.

“Naturally, uncertainty has increased as a result of oil prices and of a few mixed economic signals,” ECB executive board member Jose Manuel Gonzales-Paramo told the business daily Handelsblatt.

“But I don’t believe so far that we have to alter our forecasts. Recovery is continuing,” Gonzales-Paramo said.

Strain on dollar

World oil prices have nearly trebled from about $20 a barrel in New York at the start of 2002, but adjusted for inflation they remain below levels of $80-plus seen in the wake of the 1979 Iranian revolution.

Economists said rising energy costs were having only a muted impact on global inflation, although it has fuelled the US trade deficit, which boomed to $54 billion in August, the second biggest in history.

And high gasoline prices could test American consumer confidence, they added.

|

“It’s not so much how high the oil price goes, it’s a question of how long it stays at a higher level” Nigel Cobby, |

“For most countries, we suspect that higher oil prices have had an impact not so much through inflation but via deteriorating terms of trade,” HSBC economists wrote in a research note.

The US dollar has started to show the strain from rising oil prices, a swelling trade deficit and fragile consumer confidence, tumbling to an eight-month low against the euro, which bought $1.2480 on Monday.

“The dollar has been undermined by cyclical factors with evidence that the US economy is entering its second oil-induced ‘soft spot’ of the year,” said Derek Halpenny, economist at the Bank of Tokyo-Mitsubishi.

Rising oil prices have given a boost to gold prices, which have reached six-month highs above $420 recently.

An ounce of gold fetched $418.40 at the morning fixing on the London Bullion Market on Monday.