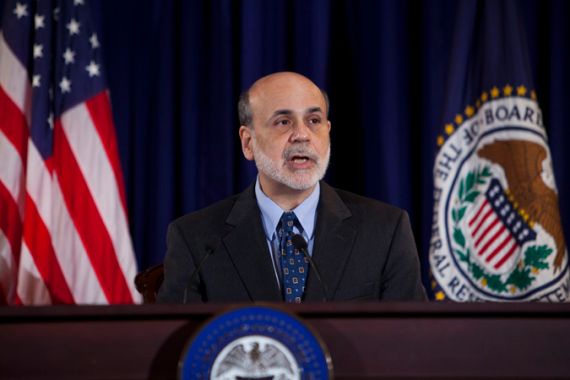

The Fed, Ben Bernanke and the rotten Libor

Ben Bernanke had an obligation as Fed chair to expose and stop the rigging of inter-bank lending rates.

The case of the rigged Libor turns out to be the scandal that just keeps on giving. It reveals a great deal about the behaviour of the Federal Reserve Board and central banks more generally.

Last month, Federal Reserve Board Chairman Ben Bernanke gave testimony before Congress in which he said that he had become aware of evidence that banks in the UK were rigging the Libor – the inter-bank lending rate and one of the primary benchmarks for short-term interest rates – in the autumn of 2008. According to Bernanke, he called this to the attention of Mervyn King, the head of the Bank of England. Apparently Mervyn King did nothing, since the rigging continued, but Bernanke told Congress there was nothing more that he could do.

Keep reading

list of 4 itemsBoeing hit with 32 whistleblower claims, as dead worker’s case reviewed

US imposes new sanctions on Iran after attack on Israel

A flash flood and a quiet sale highlight India’s Sikkim’s hydro problems

The implications of Bernanke’s claim are incredible. There are trillions of dollars of car loans, mortgages and other debts, in the United States, tied to the Libor. There are also huge derivative contracts whose value depends on the Libor at a moment in time. People were winning or losing on these deals not based on the market, but rather on the rigged Libor rate being set by the big banks.

Bernanke certainly had an obligation as Fed chair to expose and stop this rigging which was interfering with the proper working of US and world financial markets. But hey, Sir Mervyn didn’t want to take any action, what could Bernanke possibly do?

It is truly incredible that Bernanke would make such a statement to Congress and the public. There was nothing he could do about the rigging?

Suppose that he told the head of the Bank of England that he had no choice but to stop the rigging. Bernanke could have said that if King didn’t immediately take the necessary steps to end the rigging, then he would hold a press conference in which he would publicly display the evidence of the rigging and report King’s failure to take action.

Is it conceivable that this threat would have left King unmoved? Would King continue to tolerate the rigging even if could cost him his job and leave him open to public humiliation for failing to carry through his responsibilities to the people of the United Kingdom? That seems unlikely.

| Barclays faces trans-Atlantic scrutiny |

Of course, such a threat would have been rude. It would have required Bernanke to tell a fellow central bank head that he was failing in his job and that Bernanke was prepared to ruin his career in order to force him to act responsibly. Apparently, Bernanke never even considered this course of action.

This should make everyone very angry. Whatever personal relationship Bernanke has with Mervyn King and other central bank heads should be subordinate to his responsibility to ensure the integrity of US financial markets. If the latter requires that he be rude to the head of the Bank of England, then there is no question that his job requires that he be rude to Mervyn King. But that is not the way things get done in the central bankers’ club.

It is not just the Libor scandal that shows the bad effects of central banker clubbiness. Bernanke has recently committed the Fed to a policy of targeting a 2.0 per cent inflation rate. The basis for this targeting is seen as the congressional mandate for the Fed to pursue a policy of promoting price stability. Of course, that is only half of the Fed’s mandate; the other half is to pursue a policy of promoting full employment.

No prior Fed chair has seen the commitment to price stability as implying a specific inflation target, so Bernanke has taken a big leap in picking this 2.0 per cent inflation target. This is a big deal because it could mean that the Fed would neglect the other half of its mandate, the commitment to maintain full employment (as it is arguably doing now) in the interest of hitting its 2.0 per cent inflation target.

Why would Bernanke pick this 2.0 per cent inflation target? After all, there is little evidence that moderate rates of inflation in a 3.0-4.0 per cent range cause any major harm to the economy. There are hundreds of examples, including in the United States, where economies have maintained strong growth over prolonged periods with rates of inflation that exceeded 2.0 per cent.

Of course, the 2.0 per cent inflation target came from Bernanke’s friends at other central banks. Mervyn King has announced a 2.0 per cent inflation target for the Bank of England. The European Central Bank (ECB) is legally committed to a 2.0 per cent inflation target.

This legal commitment to 2.0 per cent inflation meant that when housing bubbles were growing to ever more dangerous levels in Spain, Ireland and elsewhere in the eurozone, the ECB just looked the other way. Rather than taking any steps to prevent the collapse that has devastated the eurozone’s economy, the ECB said: “What does this have to do with us?”

Bernanke apparently wants the Fed to have the same attitude. If tens of millions have their lives ruined by unemployment and/or the loss of their home, Bernanke will still be able to pat himself on the back because the Fed reached its 2.0 per cent inflation target. That’s the way things work at the central bankers’ club.

Dean Baker is a US macroeconomist and co-founder of the Centre for Economic and Policy Research.