Infographic: The US economy during Biden’s first year in office

The US jobs market is on fire, but soaring inflation is making Americans feel less confident about the economy.

One year into Joe Biden’s presidency and the economic news is decidedly mixed. Despite promising numbers in several key areas, inflation is dampening Americans’ view of the economy. We take a look at important economic indicators across the past year.

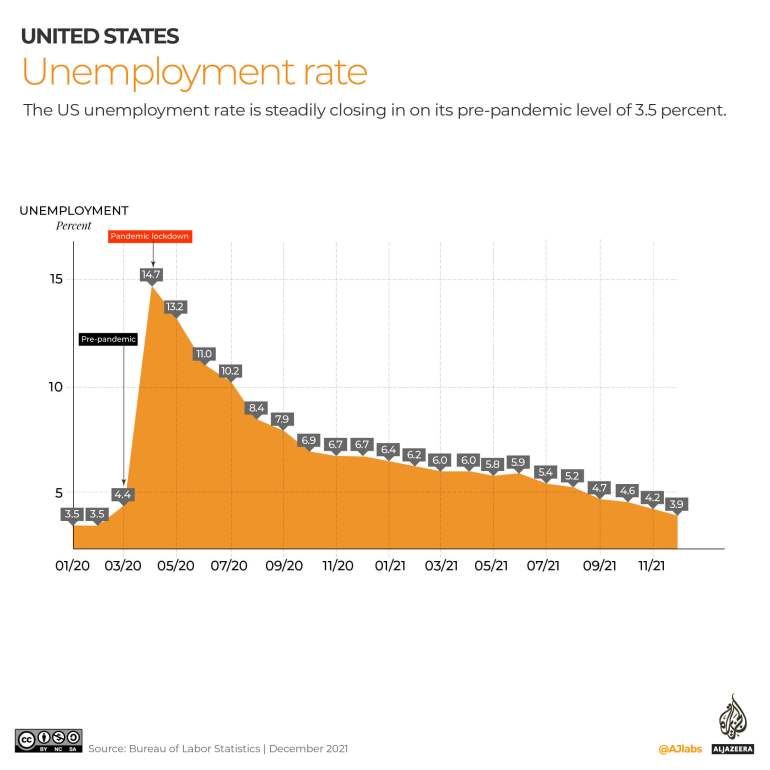

Jobs market recovery

You can’t blame President Biden for taking a victory lap where the United States jobs market is concerned. When he was sworn in on January 22, 2021, the nation’s unemployment rate was 6.9 percent. It’s currently 3.9 percent.

Keep reading

list of 3 itemsBiden’s foreign policy dilemmas

A year on, I’m still glad Biden, not Trump, is president

Last month was the first time since the pandemic struck that the jobless rate dipped below 4 percent as it closed in on its pre-pandemic level of 3.5 percent from February 2020.

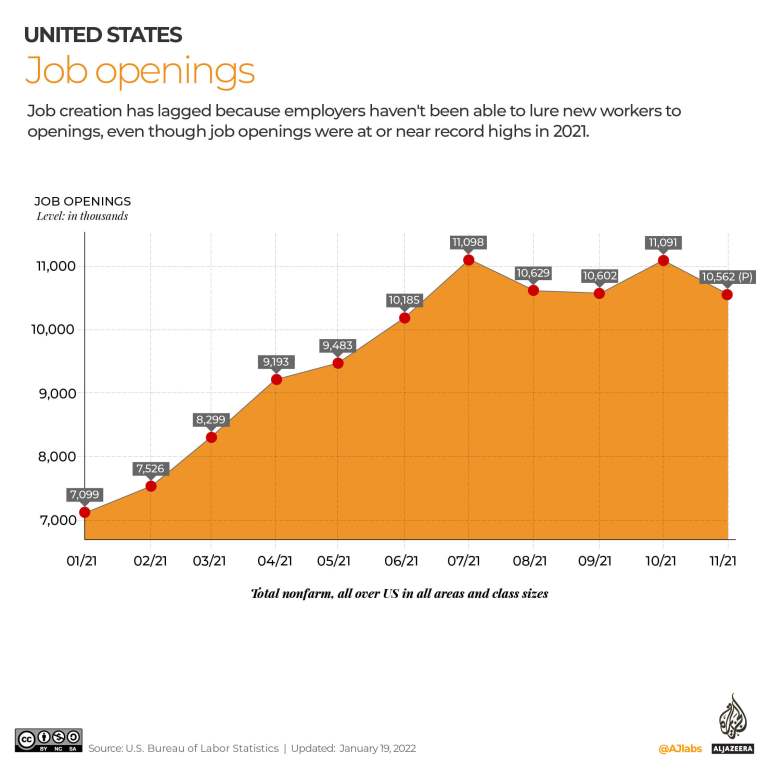

But the economy only created a disappointing 199,000 jobs in December. For the whole of 2021, job growth averaged 537,000 a month. That leaves the US 3.6 million jobs shy of regaining all of the 22 million jobs lost in the opening months of the pandemic back in 2020.

But don’t let that gap fool you. The jobs market is on fire in the US. So much so that American workers haven’t enjoyed this kind of bargaining power for decades.

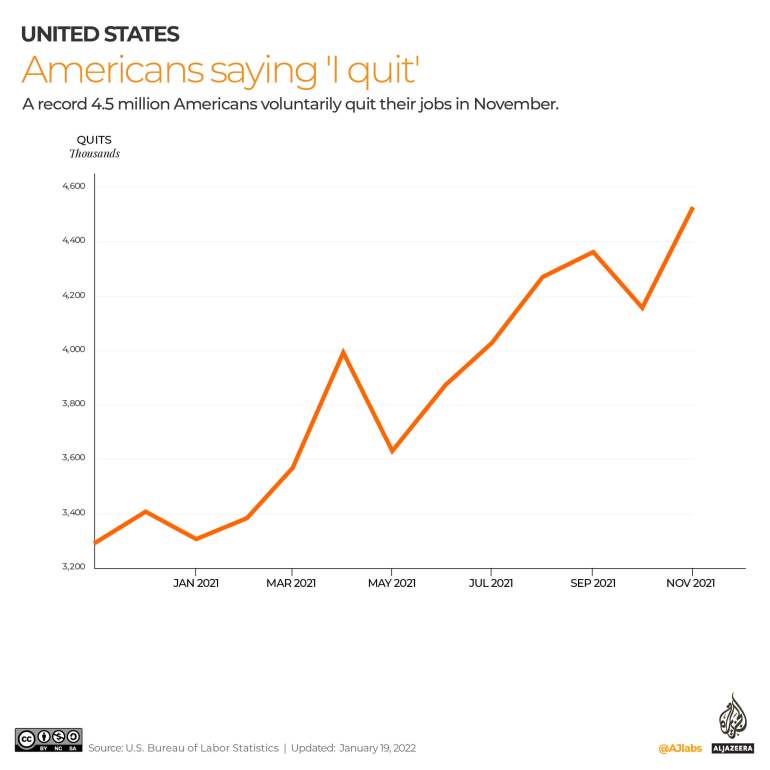

‘I quit’

To get an idea of just how hot the jobs market is in the US, take a look at how many Americans are telling their bosses, “I quit”.

A record 4.5 million Americans voluntarily quit their jobs in November, signalling that workers feel very confident about their employment prospects. That’s not surprising given job openings on the final day of November were also near a record high.

To lure scarce job seekers, businesses have been boosting pay and sweetening benefits packages. That trend continued in December, with average hourly earnings for all employees on private nonfarm payrolls increasing 4.7 percent from a year ago.

But fatter paycheques, while welcome, are not stretching as far as they did before Biden took office, thanks to surging inflation.

Inflation

Feel like putting on a pair of leg warmers and doing some jazzercise to Olivia Newton John’s, Physical?

Well, that vibe you’re feeling could be down to the early 1980s-like inflation in the US.

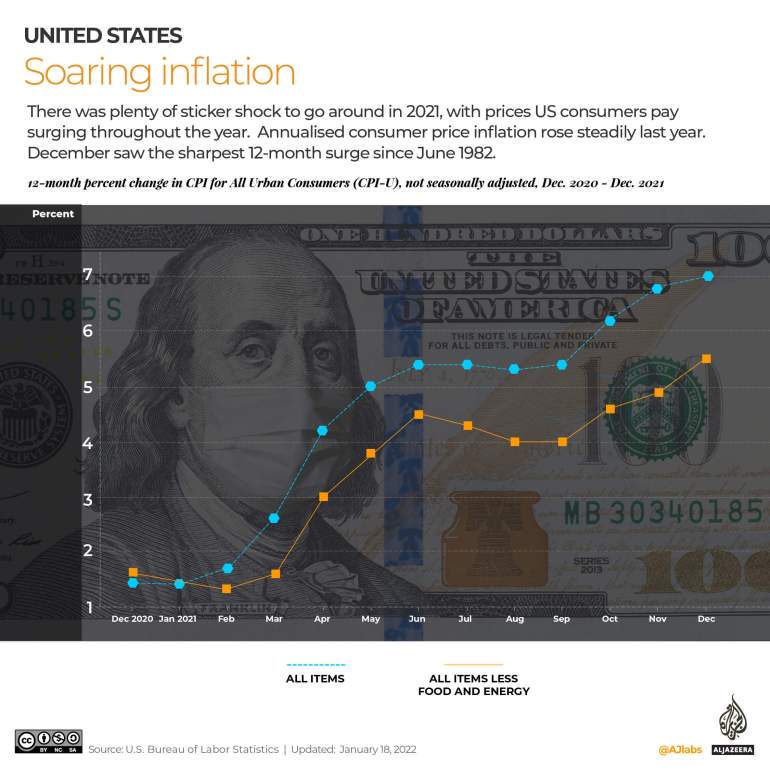

The consumer price index increased 7 percent in December compared with the same period a year ago. That is the sharpest 12-month spike since June 1982.

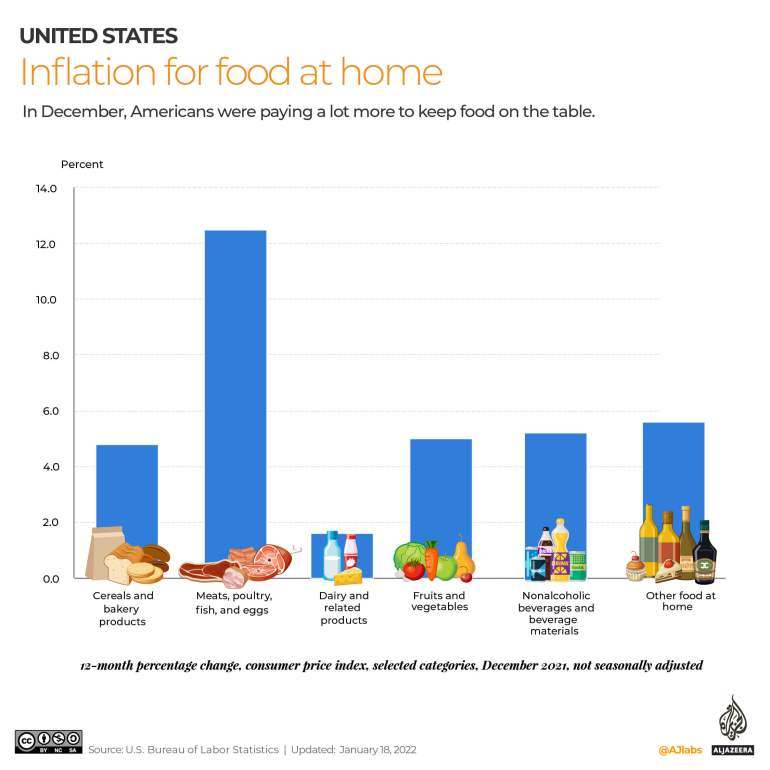

No one likes rising prices, but this year’s inflation has been especially hard on low-income households. Inflation, especially for essentials such as food, petrol and housing, has consumed a larger share of their financial resources.

So even though the jobs market is recovering nicely, and workers are in a great bargaining position to secure better pay and benefits, mounting price pressures are making American feel less optimistic about the economy.

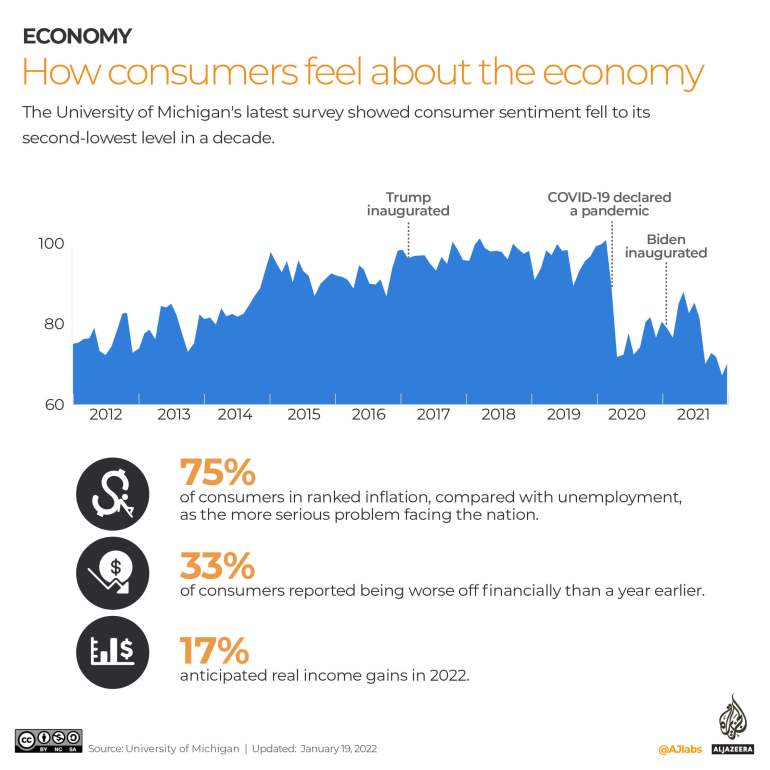

Consumer confidence

What do you get when you combine soaring inflation with surging Omicron infections? A dip in consumer confidence.

The latest survey by the University of Michigan suggested consumer sentiment fell in January to its second-lowest level in a decade.

That’s definitely concerning because when consumers don’t feel good about the economy, they tend to be more tight-fisted with money. And consumer spending accounts for some two-thirds of US economic growth.

The University of Michigan survey indicated that three-quarters of Americans think inflation is a bigger problem for the nation right now than jobs. Meanwhile, a third reported being worse off financially compared with a year ago.

That is definitely clouding how Americans feel about Biden’s leadership.

A Quinnipiac University national poll published earlier this month indicated only 34 percent of Americans approve of Biden’s handling of the economy, while 57 percent disapprove.