Ether hits all-time high

Ether rose to as high as $4,643 in Asian hours, taking the week’s gain to more than 10 percent.

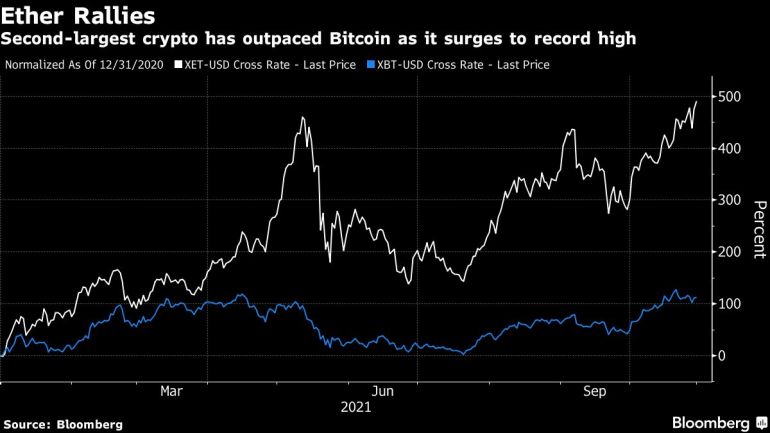

Ether, the world’s second-largest cryptocurrency, has hit an all-time high, catching up with Bitcoin’s rally and riding on news of wider blockchain adoption.

The Ether token, which underpins the Ethereum blockchain network, rose on Wednesday to as high as $4,643 in Asian hours, breaching the previous day’s $4,600 and taking the week’s gains to more than 10 percent.

Keep reading

list of 4 itemsUS emerges as biggest Bitcoin miner after China crypto crackdown

Love them or hate them: Cryptocurrencies are here to stay

Ethereum cryptocurrency soars to an all-time high

In the days since Bitcoin, the world’s largest cryptocurrency hit its record high of $67,016.5 on October 20, other tokens on the base layer of blockchain networks, known as Layer 1 networks, have gathered momentum.

Bitcoin (BTC) was trading at approximately $63,078 and is up about 117 percent this year, while Ether is up six-fold.

“Since the market reversal at the end of September, Ether’s strength has been moving in stride with BTC and other majors,” said Ryan Rabaglia, the managing director and global head of trading at digital asset platform OSL.

“Ethereum has been the clear winner of the Layer-1s for what we believe will be a substantial shift in a potentially prolonged market sentiment uplift. Ethereum will also continue to play a big role in the NFT [non-fungible token] and metaverse ecosystem build-out,” he said. NFTS are a kind of crypto asset that records ownership of digital items

The steady stream of news on cryptocurrency adoption by banks, growth of non-fungible tokens on virtual gaming platforms, the launch of Bitcoin futures-based US ETFs [exchange-traded fund] and a need among investors for diversification in an uncertain interest rate environment have pushed several blockchain tokens, including Bitcoin and Ether, higher since October.

Smaller tokens, too, have seen rising interest after Facebook Inc rebranded itself into Meta to focus on building the “metaverse”, a shared virtual environment.

Australia’s largest bank, Commonwealth Bank of Australia, said on Wednesday it will become the country’s first to offer retail clients crypto services.

According to digital assets researcher CryptoCompare, assets under management (AUM) in digital investment products rose 45.5 percent in October to a record high of $74.7bn. The total AUM for Bitcoin-based products grew 52.2 percent to $55.2bn, while Ethereum-based funds AUM increased 30 percent to $15.9bn, record highs for both categories.