GameStop rally pauses as trading platforms bar purchases

GameStop shares swung between double-digit losses and gains in the opening minutes of New York trading after clients of Robinhood reported trading restrictions in high-flying stocks, including GameStop and AMC Entertainment Holdings Inc.

GameStop Corp.’s wild trading continued Thursday amid trading restrictions on platforms such as Robinhood Markets.

The shares swung between double-digit losses in gains in the opening minutes of New York trading after clients of Robinhood reported trading restrictions in high-flying stocks, including GameStop and AMC Entertainment Holdings Inc.

Keep reading

list of 4 itemsStocks slide on Middle East tensions as hope crisis contained stems losses

As US inflation ticks back up, it could impact the presidential election

Will the US unemployment rate continue at historic lows?

Those stocks and others are “not supported” on Robinhood, according to a note on at least one of its platforms. Interactive Brokers has put AMC, GameStop, BlackBerry Ltd., Express Inc. and Koss Corp. option trading into “liquidation only” due to the extraordinary volatility in the markets, the company said in a tweet. On Wednesday, Charles Schwab Corp.’s TD Ameritrade also curtailed transactions on GameStop, AMC and other securities.

“I’m actually surprised that trading platforms are getting involved,” said Wedbush Securities Inc. analyst Michael Pachter. “Unless there is something screwy about the trading that suggests manipulation, they really should get out of the way and allow investors to trade whatever they wish.”

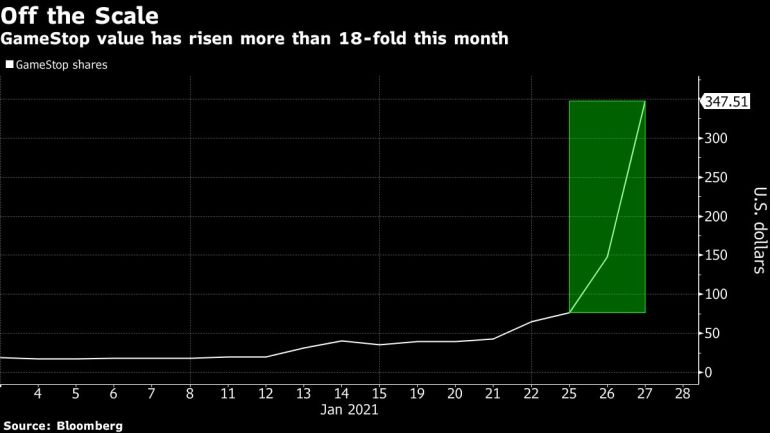

GameStop had surged more than 40% earlier, momentarily pushing the stock above $500. It’s advanced more than 1,700% this year, fueling a rally in retail trading across the board and leading some short sellers to throw in the towel.

Trading has remained volatile since the last regular U.S. session, in which the stock rose 135%. Gains were briefly pared postmarket after the Reddit page that has fueled this month’s surge was made private and then later reopened by the group’s moderators. In the time the original WallStreetBets board was down, an alternate forum called Wallstreetbetsnew topped 350,000 members.

January’s breathtaking gains in the stock have boosted GameStop’s market value to about $24 billion, making it bigger than more than a third of the companies in the S&P 500 Index. Only Plug Power Inc. is larger in the closely-watched Russell 2000 Index, a far cry from the end of 2020 when GameStop, then a $1.3 billion company, was firmly in the middle of that gauge.

“This will burn itself out, like any other mania, but there will likely to be some impact on the market as a whole,” said Marshall Front, chief investment officer at Front Barnett Associates. “That these eye-popping moves happen after a nearly 70% move in the S&P since March shows there’s plenty of room for a pullback.”

Gamestop’s rise has prompted analysts at Citigroup Inc. to warn investors that some exchange-traded funds face an outsized influence from the video-game retailer as its boom has altered their composition. Analyst Scott Chronert advised clients to take “special note” of ETFs that incorporate leverage in their funds. A larger allocation to the stock may materially change fund performance for now until rebalance dates occur, he said in a report.

Shorts Exit

The Reddit community has dominated equities trading all week as retail traders target heavily shorted shares, causing ripples across the market. Investors including Melvin Capital closed out its short position on GameStop, while Muddy Waters’s Carson Block said he “massively reduced” its short positions in recent days to avoid getting burned.

The day-trading phenomenon landed in Washington on Wednesday, when the White House press secretary said U.S. Treasury Secretary Janet Yellen and the Biden administration’s economic team are watching stock-market activity around GameStop and other heavily shorted companies. Federal Reserve Chair Jerome Powell dodged questions on the topic at his regular policy press conference.

Senator Elizabeth Warren weighed in, saying she intends to make sure securities regulators “wake up and do their jobs.” Not long after, the Securities and Exchange Commission said it is “actively monitoring” volatility in options and equities markets.

(Updates with added details throughout.)

–With assistance from Namitha Jagadeesh, Elena Popina and Bailey Lipschultz.