2020 US election: Wall Street rallies as Main Street reels

The odds of the United States Senate flipping to Democratic control are growing slimmer, which is good news for Wall Street but likely spells protracted pain for struggling workers and businesses.

A premature declaration of victory. Accusations of fraud. And cliffhanger vote counting that could stretch on for days. Welcome to the race for the most powerful office in the world’s largest economy.

For now, Wall Street is shrugging off the uncertainty surrounding the United States presidential election. Stocks rallied on Wednesday as investors focused instead on the outcome that could really hit them in the wallet – a major shake-up of the US Senate.

Keep reading

list of 4 itemsTrump or Biden, whoever wins has a deeply unequal economy to fix

Trump’s stimulus U-turn: Why it matters to you and the economy

Trump campaign wants a Wisconsin recount. But how would it work?

While the White House sets agendas on taxes and spending, it is Congress that ultimately controls the purse strings in America.

Right now, Republicans dominate the Senate. And though there was much speculation of a “blue wave” sweeping Democrats to power in both houses of Congress, the odds of the Senate flipping blue are looking way slimmer now than they were on Tuesday.

Even if Democratic presidential candidate Joe Biden wins the Oval Office, a Republican-controlled Senate could quash his biggest economic priorities, including proposed tax hikes. Biden has proposed increases in the capital gains tax – which is where owners of assets like stocks make a lot of their money – as well as higher tax rates for corporations and wealthy Americans.

With the Senate in Republican hands, those proposals are likely to be dead on arrival – a scenario that’s cause for celebration on Wall Street. But down on Main Street, in the real economy where millions of Americans are still wrestling with the fallout from the COVID-19 pandemic, there is little reason to party.

A prolonged vote count or contested election bodes poorly for the White House and Democrats in Congress to break their months-long stalemate over a new round of coronavirus relief aid.

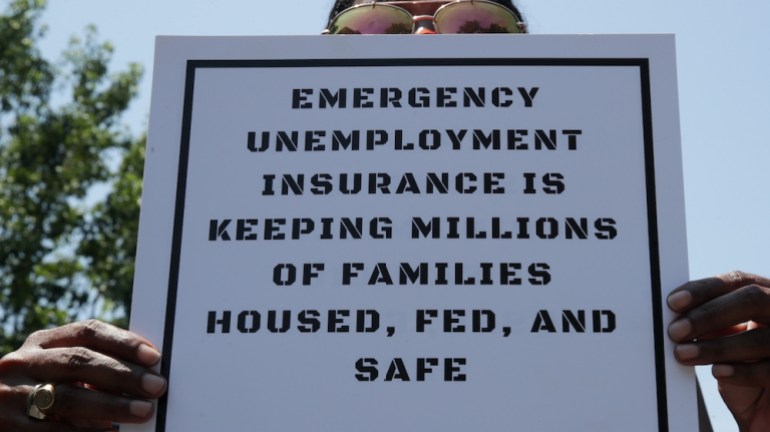

Federally enhanced unemployment benefits and financial lifelines to small businesses – which accounted for two-thirds of new jobs creation prior to the pandemic – expired at the end of July.

More federal protections are set to lapse at the end of December – including the moratorium on evictions from the US Centers for Disease Control and Prevention.

Adding to the pressure is the fact that surging COVID-19 infections in parts of the country are already leading state and local governments to order new rounds of business-sapping restrictions and shutdowns.

The economy did stage a remarkable bounce-back in the third quarter – but not enough to fully recapture its pre-pandemic strength. And it is a deeply unequal recovery, with millions of people being left behind, including women and people of colour.

Only around half of the 22 million jobs lost to lockdowns in March and April have been recovered. Low-income and minority workers, as well as women, continue to bear the brunt of the virus’s economic carnage. Inequalities that had started to narrow last year when the jobs market was on fire are now worsening.

Economists and the Chairman of the Federal Reserve, Jerome Powell, have been urging Congress to pass a new stimulus package quickly to keep America’s recovery on the rails. Because many indicators are showing a downshift.

The latest evidence dropped on Wednesday after payroll provider ADP said US firms added 365,000 jobs in September – way, way fewer than expected. The results could portend a disappointment on Friday when the government releases the closely watched monthly jobs report for October.

Before that, the Fed will conclude its two-day policy meeting on Thursday. With so much uncertainty surrounding the election, the US central bank, which fiercely guards its independence against the stain of politics, is unlikely to make any move that could be construed as favouring one side of the political spectrum over another.

In the months ahead, though, the onus for keeping this recovery on track is likely to fall further on the Fed’s shoulders.

Even if lawmakers break their deadlock and pass a new round of virus relief before the year is out or even early next year, it will probably be far more modest in scope than the $2.2 trillion aid package the Democrats have been pushing for.

Goldman Sachs analysts reckon that if the Republicans preserve a narrow majority in the Senate, the stimulus package could be less than $1 trillion.

After the Great Recession of 2007-2009, Congress passed one round of stimulus worth $787bn and then failed to pass subsequent packages to reset the economy. So the Fed stepped into the breach, wielding its blunt instrument of monetary policy. Many economists reckon that the recovery could have been swifter if only Congress hadn’t been so stingy.

The spectre of smaller stimulus measures – passed later rather than sooner – will prompt many economists to revise their forecasts for US economic growth downward.

But rock-bottom interest rates are beloved by Wall Street because it prods investors to seek higher returns in riskier assets – like stocks.

So no matter who wins the White House, there’s one thing Americans can likely count on in the months ahead: Wall Street will get richer and Main Street will keep treading water.