WeWork drama: Neumann gives up control of company and CEO role

The decision came after the office-sharing startup postponed its IPO following investor pushback

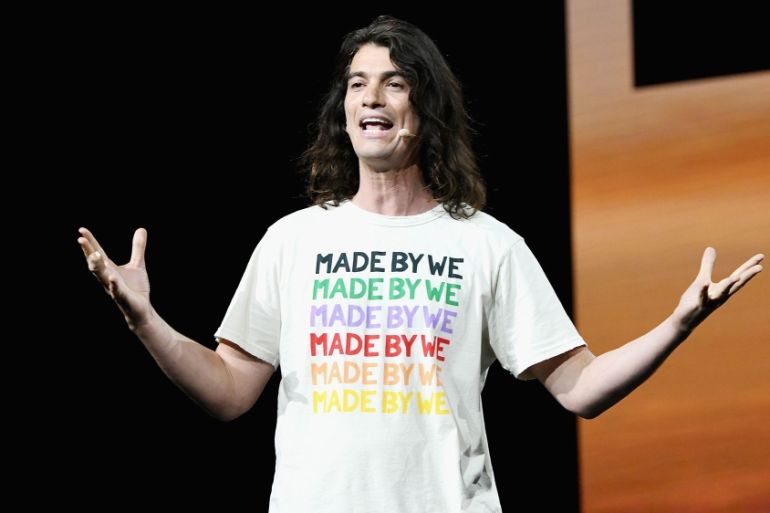

WeWork cofounder Adam Neumann agreed on Tuesday to resign as chief executive and give up majority voting control, after SoftBank Group Corp and other shareholders turned on him over a plunge in the United States office-sharing startup’s estimated valuation.

The decision came after We Work parent We Company postponed its initial public offering (IPO) last week following pushback from prospective investors, not just over its widening losses, but also over Neumann’s unusually firm grip on the company.

Keep reading

list of 4 itemsBehind India’s Manipur conflict: A tale of drugs, armed groups and politics

China’s economy beats expectations, growing 5.3 percent in first quarter

Inside the pressures facing Quebec’s billion-dollar maple syrup industry

This was a blow for SoftBank, which was hoping for We Company’s IPO to bolster its fortunes as it seeks to woo investors for its second $108bn Vision Fund.

SoftBank invested in We Company at a $47bn valuation in January. But investor scepticism led to the startup considering a potential IPO valuation of as low as $10bn earlier this month, Reuters reported.

We Company had vowed to press ahead with an IPO by the end of the year. But there was little sign that IPO investor sentiment would change, threatening the value of company shares held not only by outside investors, but by Neumann as well.

What was the venture capital world’s biggest upset then morphed into one of corporate America’s most high-profile boardroom dramas. SoftBank managed to muster enough opposition to Neumann in a meeting of We Company’s seven-member board on Tuesday to convince him to step down. Reuters had reported on Monday that Neumann had engaged in talks about changes to his role.

“In recent weeks, the scrutiny directed towards me has become a significant distraction, and I have decided that it is in the best interest of the company to step down as chief executive,” Neumann said in a statement.

Artie Minson, currently chief financial officer of WeWork parent We Company, and Sebastian Gunningham, a vice chairman for the New York-based startup, will become co-chief executives, the company said. Neumann will stay on the board as non-executive chairman, the company added.

Minson will oversee We Company’s finance, legal, human resources, real estate, and public communications, while Gunningham will take responsibility for product design, development, sales, marketing, technology and regional teams.

Neumann also agreed to reduce the power of his voting shares, losing majority voting control, according to sources. Each of his shares will now have the same voting rights as three We Company common shares, not the 10 common shares that they previously had, the sources said.

Neumann’s shares used to have the same voting power as 20 We Company common shares before he agreed earlier this month to reduce his grip in an unsuccessful attempt to make the IPO more attractive to investors.

We Company said on Tuesday it was now evaluating the “optimal timing” for an IPO.

Firm grip

Neumann, whose net worth is pegged by Forbes magazine at $2.2bn, developed a cult following among many We Company employees, vowing to “elevate the world’s consciousness” as he sought to establish WeWork as a brand that transcended office sharing.

While his investors were willing to entertain his eccentricities during the decade he led WeWork since its 2010 founding, his freewheeling ways and party lifestyle came into focus once he failed to get the company’s IPO under way.

During the company’s attempts to woo IPO investors this month, Neumann was criticised by corporate governance experts for arrangements that went beyond the typical practice of having majority voting control through special categories of shares.

These included giving his estate a major say in his replacement as CEO, and tying the voting power of shares to how much he donates to charitable causes.

Neumann also entered several transactions with We Company over the years, making the company a tenant in some of his properties and charging it rent. He has also secured a $500m credit line from banks using company stock as collateral.

Late concessions

Following criticism from potential investors, Neumann agreed to some concessions without relinquishing majority control. He agreed to give We Company any profit he receives from real estate deals he has reached with the New York-based startup.

These changes did little to address concerns about the business model of We Company, which rents out workspace to clients under short-term contracts, even though it pays rent under long-term leases. This mix of long-term liabilities and short-term revenue raised questions among investors about how the company would weather an economic downturn.

Neumann, 40, is not the first founder of a major startup to be forced to step down in the last few years. Uber Technologies Inc cofounder Travis Kalanick resigned as CEO of the ride-hailing startup in 2017 after facing a rebellion from his board over a string of scandals, including allegations of enabling a chauvinistic and toxic work culture.

Uber replaced Kalanick with an outsider, former Expedia Group Inc CEO Dara Khosrowshahi, and completed its IPO last May.