US stocks fall, weighed down by the tech sector

US markets end a four-day winning streak.

After being up more than one percent earlier in the day, United States stocks fell on Tuesday, pulled lower by a drop in technology shares, despite optimism over a potential reopening of the US economy.

The Dow Jones Industrial Average fell 0.13 percent, to 24,101.55, ending a four-session winning streak. The S&P 500 – a proxy for the health of US retirement and college savings accounts – slid 0.52 percent. The Nasdaq Composite Index dropped 1.40 percent.

Keep reading

list of 3 itemsHSBC’s profit plunges by half in first quarter on coronavirus hit

Once recession-proof, US trucking is squeezed by coronavirus

More:

Apple lost 1.6 percent, Amazon shed 2.5 percent of its value, and Facebook fell 2.5 percent. Shares of the video streaming service Netflix fell 4.2 percent.

“The stock market today is about money coming out of tech and going into economically sensitive value stocks, where prices have suffered the most,” said Tim Ghriskey, chief investment strategist at Inverness Counsel in New York. “The sense that states are opening up and the economy is beginning to grow again is causing this rotation.”

Tennessee, Georgia, and Alaska are among the US states that have already started easing coronavirus lockdown measures. And other states have announced they will soon begin reopening parts of their economies as well.

But with US coronavirus cases topping one million, a predictive model often cited by White House officials warned the country’s death toll could climb higher than previously projected if states reopen prematurely.

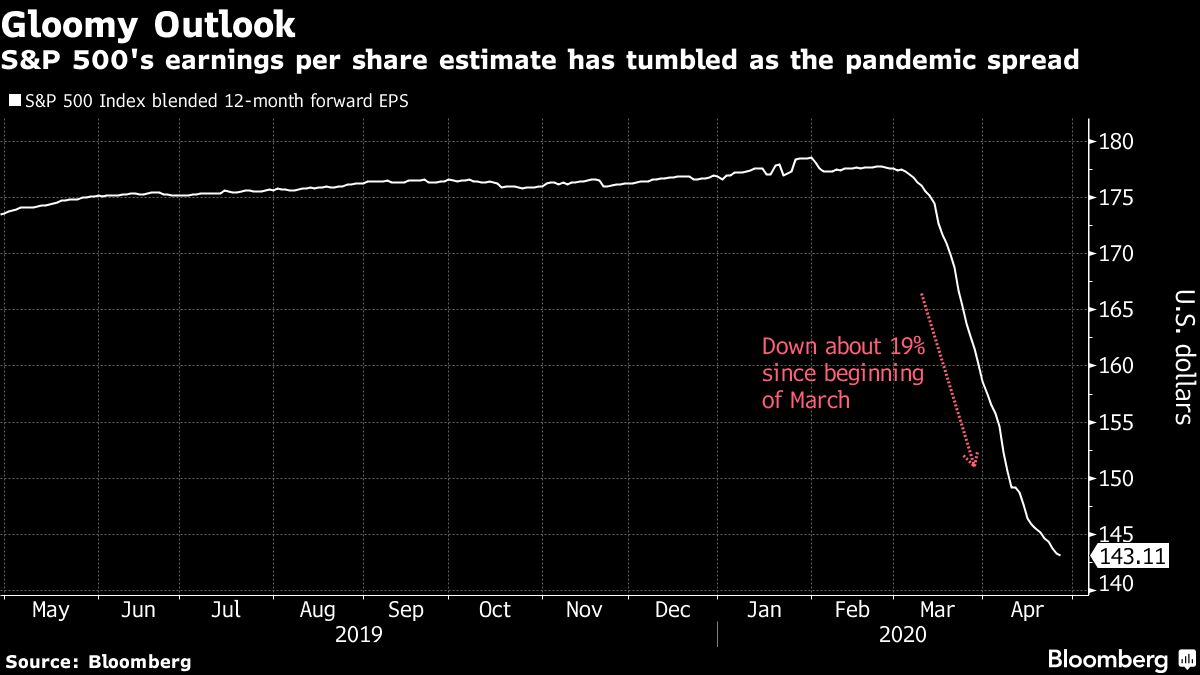

First-quarter earnings season has shifted into high gear, with S&P 500 earnings now expected to be down 14.8 percent from a year ago, a dramatic U-turn from the 6.3 percent year-on-year growth seen on January 1, according to Refinitiv data.

Some 26.5 million Americans have applied for unemployment insurance in the last five weeks. Another weekly reading on initial jobless claims is due on Thursday.

Consumer confidence plunged in April, with the “current conditions” component suffering its largest drop ever, according to the Conference Board.

“As long as the economy doesn’t open up too quickly and cause the infection rate to increase, it seems like the virus has peaked and is perhaps on the decline, giving the consumer hope that the economy will get going again,” Ghriskey added.