Bloated budget: Will ‘fiscal pickle’ stimulate US economy?

United in deeming Phillips curve ‘dead’, both Trump’s adviser and AOC want to run big deficits to prolong the expansion.

In a bizarre moment of ideological harmony in mid-July, Republican United States President Donald Trump‘s economic policy adviser, Larry Kudlow, saw eye to eye with Democratic Representative Alexandria Ocasio-Cortez on something very symbolic.

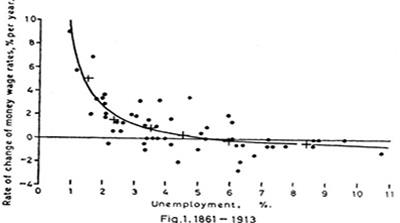

The young Congresswoman was questioning Federal Reserve Chairman Jerome Powell about whether the Phillips curve – an economic model fashioned in the 1950s – is relevant today. According to the reality it describes, if more people have jobs, then prices rise. Generations of policymakers have operated under the assumption that there is a direct relationship between employment and inflation.

Keep reading

list of 4 itemsEcuador weighs security, international arbitration in latest referendum

‘Triple spending’: Zimbabweans bear cost of changing to new ZiG currency

Boeing hit with 32 whistleblower claims, as dead worker’s case reviewed

But recent economic data suggest the Phillips curve may not explain the current economy. The US has low joblessness, but consumer prices are barely rising.

Employment is at a 50-year high, but wage growth – and thus inflationary pressures – remain tepid. Surprisingly, both Ocasio-Cortez and Kudlow, who chairs the White House’s National Economic Council, agreed about the policy implications of this conundrum.

While the progressive New York legislator and the conservative Trump financial guru may not have identical proposals for how to boost economic growth, they embrace similar monetary and fiscal ideas.

On the monetary front, they are both cheerleading the dovish campaign by the Fed to extend the longest-ever US economic expansion. The fed cut interest rates on July 31 – and may do so again.

And on the fiscal side, both are pushing to open the floodgates with new stimulus.

To be fair, Kudlow’s ideas are backed by the theory of supply-side economics, which argues for a reduction in tax rates to grow the economy.

And Ocasio-Cortez has supported Modern Monetary Theory (MMT), which encourages governments to spend money to stimulate job creation and reinvigorate the economy.

These divergent approaches share the premise that deficit spending is good and fiscal conservatism is bad.

Central bank action

Kudlow, the Assistant to the President for Economic Policy, praised Ocastio-Cortez for downplaying inflation risks as the US central bank slashes the federal funds rate.

“I’ve got to give her high marks for that,” he told the Fox News channel on July 11, signifying that he too believes unemployment could be driven even lower without sparking dangerous inflation.

Some economists believe that globalisation and decreased American worker leverage have relegated the Phillips curve to oblivion. Others say the official unemployment rate overstates the tightness of the job market – because it ignores those who have left the labour force. E-commerce is another reason cited for why the unemployment rate and inflation might be permanently decoupled, according to a brief published by the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution.

Regardless, Kudlow told Fox he hoped to rendezvous with the young representative to discuss shared views on the Fed.

“She got it right,” Kudlow said to reporters at the White House, again referring to Ocasio-Cortez and their mutual embrace of stimulative action. “[Fed chairman Powell] confirmed that the Phillips curve is dead. The Fed is going to lower interest rates.” And Kudlow was correct in his prediction.

If the Phillips curve is completely ignored, then the Fed may continue to have more flexibility while still ensuring price stability. Growth will be ignited again – optimists hope – without the risk of much inflation.

Scott Sumner, an economist at George Mason University’s Mercatus Center, says the Fed’s easing this week will “boost aggregate demand, which will help to prolong the expansion … at very slight risk of economic overheating”.

“A rate cut is clearly appropriate, given the plunging interest rates around the world,” Sumner told Al Jazeera, adding that “most countries will benefit from a longer US expansion”.

MMT meets supply-side

The supply-side school – with which Kudlow is affiliated – advocates for government to run deficits by reducing the tax burden. That idea, tried by several Republican presidents – including Ronald Reagan and George W Bush – aims to promote growth that in turn generates more tax revenue.

But such policies – dubbed “voodoo economics” by critics – have generally increased budgetary woes, in addition to stimulus.

Ocasio-Cortez is an energetic proponent of Modern Monetary Theory, which – in the same vein – does not mind going into the red. MMT argues that nations borrowing money in their own currencies have no limit to incurring public debt. This creates more capacity for spending on ambitious healthcare, education, and climate programmes.

The Congresswoman may have hinted that the Phillips curve is defunct, but she has also called for raising taxes to help balance out massive new expenditures.

A spokesperson for Ocasio-Cortez contacted by Al Jazeera declined to comment on her fiscal platform.

MMT is built on the controversial foundation that government creates money when spending. It holds that the US cannot default on its own dollar-denominated debt, and that running deficits does not require tax collection or bond issuance beforehand.

However, MMT does say government purchasing is limited by inflation, which is unleashed only when labour resources are fully utilised – ostensibly through a jobs guarantee.

Supply-side and MMT ideas irritate fiscal conservatives because they both appear unbothered by real resource constraints. Although Keynesian economics – developed by John Maynard Keynes in the 1930s – also advocates for deficit spending to fend off recessions, these polarising theories from opposite sides of the aisle go one step further.

‘Fiscal pickle’

While conventional economics argues that excessive deficit spending “crowds out” investment, MMT seeks to entice investment with public spending that it says actually lowers interest rates and “crowds in” economic activity.

But Edwin Truman, a senior fellow at the Peterson Institute for International Economics, said that despite superficial similarities and goals, supply-side economics and MMT are still far apart.

“Supply-side is about improving incentives for the economy to produce,” Truman said. “MMT is about spending as much as you want to spend and being able to avoid inflation.”

“We’re in a bit of a fiscal pickle because we have a very large deficit, and we’re adding to the federal debt quite rapidly,” he told Al Jazeera, saying that kick-started growth comes with major costs.

“The idea that deficits don’t matter for countries that can borrow in their own currency, I think, is just wrong,” Fed Chairman Powell told the US Senate’s Banking, Housing and Urban Affairs Committee in February.

“We’re going to have to either spend less or raise more revenue,” said Powell.

However, Truman said that when the price level in the economy is quiescent – as inflation is dormant – “more output would increase wages” without a problem.

Yet Truman remains unbowed by the heterodox views uniting Kudlow and Ocasio-Cortez.

“[The Phillips curve] is still there, but may depend upon circumstances for what shape it takes,” he said.