India slashes corporate taxes in multibillion-dollar growth bid

The economic effect, however, could be fairly small as a majority of Indian companies do not pay taxes.

In yet another move to revive its sluggish economy, India‘s government has significantly reduced corporate taxes, seeking to boost investment in a business sector plagued by slowing demand, trade concerns and record-high unemployment.

The unexpected tax cuts come after the Reserve Bank of India, the central bank, announced a $24bn payout to the central government in August and Governor Shaktikanta Das cut interest rates four times in 2019 to a nine-year low.

Keep reading

list of 4 itemsBehind India’s Manipur conflict: A tale of drugs, armed groups and politics

China’s economy beats expectations, growing 5.3 percent in first quarter

Inside the pressures facing Quebec’s billion-dollar maple syrup industry

“We want to have more investments and ‘Make-in-India’, which itself means a lot more investment, a lot more employment generation, a lot more economic activity,” Finance Minister Nirmala Sitharaman said on Friday.

Her ministry slashed the corporate tax rate for domestic companies to 22 percent from 30 percent.

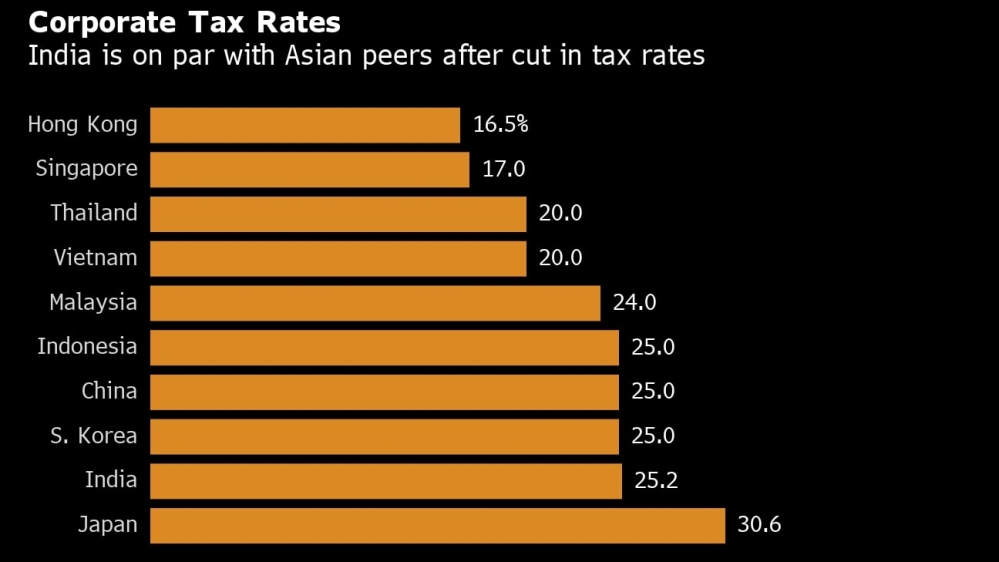

The effective new tax rate for domestic companies, which includes all additional levies and surcharges will be 25.17 percent, Sitharaman read from a statement.

Domestic manufacturing companies that are formed after October 1 will pay even less. They will face taxes of 15 percent, or 17 percent including surcharges and levies. To be eligible, these companies would have to start production by March 31, 2023.

The tax cuts raised concerns over commitments made by the government, led by Prime Minister Narendra Modi, to keep to its budget deficit target of 3.3 percent for its 2019/2020 fiscal year.

“We are conscious of the impact this will have on our fiscal deficit,” Sitharaman told reporters at a news conference on Friday, adding that the government expects to lose 1.45 trillion rupees ($20.5bn) a year in revenues from the latest corporate tax cut.

However, the boom in economic activity that the government expects to generate with the tax cuts should deliver greater revenue, she said.

“The idea is that economic buoyancy will itself generate enough reasons for better revenue generation.”

Sitharaman also emphasised that the measures are meant to strengthen the country’s “Make-in-India” policy, which aims to give incentives to local manufacturers.

She also said the moves make India’s corporate tax rates more competitive among regional peers.

Indian shares surged on the news, with its benchmark S&P BSE Sensex climbing more than five percent in mid-morning trade.

The South Asian economy is struggling to recover from a six-year low in GDP growth, and analysts have not been optimistic on the effects of Sitharaman’s previous measures, which include merging state banks, scrapping a tax on foreign funds and allowing concessions on vehicle purchases.

The latest round of tax cuts may also be underwhelming for the economy, said Shilan Shah, senior India economist at Capital Economics.

“The impact would be fairly small because a vast majority of India’s companies – the small and medium enterprises – don’t even pay corporate taxes,” Shah told Al Jazeera.

The Singapore-based economist says these types of firms make up more than 90 percent of companies, comprising the “backbone of India’s economy”, but may not receive any relief from the new tax measures.

“A [interest] rate cut would be more effective because they affect SMEs,” he said.

RBI Governor Das said on Thursday there is more room for interest rate cuts to spur the country’s economic growth.

But Rajiv Biswas, executive director and Asia-Pacific chief economist for UK-based IHS Markit, said the tax cuts would “boost” the Indian economy “over the next two or three years” and help improve the country’s competitiveness for both domestic and foreign companies.

“From a fiscal perspective, the Indian government has made progress in reducing its fiscal deficit over the past five years, so has some leeway to provide stimulus,” Biswas told Al Jazeera.

“Moreover, Indian policymakers cannot sit around like ducks in thunder as the economy slows, and are delivering both monetary and fiscal policy stimulus measures to try to boost Indian economic growth as concerns mount about slowing growth momentum of the economy in recent quarters.”