EU power sector emissions drop as coal collapses across Europe

The year 2019 saw record decline in CO2 emitted from electricity generation as renewable sources rose to a new high.

The European power sector emitted 12 percent less carbon dioxide in 2019 than during the prior year, suggesting the continent has sped up its shift away from fossil fuel energy sources. During the same period, the share of energy from renewables increased to almost 35 percent, according to a new report by two European climate think-tanks.

According to the findings, published Wednesday in a joint report by Agora Energiewende in Germany and Sandbag in the United Kingdom, emissions fell last year by 120 million tonnes. Power generation from hard coal declined in every European Union country and sank by 24 percent overall.

Keep reading

list of 4 itemsAfter the Hurricane

Photos: Dubai reels from flood chaos as record rains lash UAE

Ecuador declares energy emergency amid severe regional drought and El Niño

The coal energy that left the market was replaced in nearly equal measure by natural gas and renewable energy.

And for the first time ever, renewables such as wind and solar power produced more energy for Europe than coal plants. Moreover, the report said, the countries that were most ambitious with renewables saw the biggest decrease in their electricity market prices.

‘Not competitive’

Christoph Podewils, a spokesman for the Berlin-based Agora Energiewende, said that the changes were “triggered by the carbon pricing of the European emissions trading system [ETS]”.

The ETS market cap-and-trade scheme is the world’s first and biggest such policy to fight climate change. Under the greenhouse gas emissions limit, companies from the energy, industrial and intra-European aviation sectors can buy and exchange credits.

“Coal power is now more expensive than [power from] other sources,” Podewils told Al Jazeera. “It’s not competitive anymore.”

He said that the European carbon price hovering around 25 euros ($27) per tonne provided “security to all those investors to deliver on renewable energy and efficiency targets”.

Germany, Spain, Italy, the Netherlands and the UK accounted for 80 percent of the decline in energy produced from hard coal.

Electricity produced by nuclear plants decreased slightly, while energy from natural gas rose 12 percent from the previous year.

‘Priced out’

“The least efficient plants in Europe just get priced out,” said Dave Jones, a power analyst at Sandbag who described coal as “uneconomic” in the long term.

He told Al Jazeera that coal was “basically priced out of the market against natural gas”.

“Generally [coal-fired plants] are not covering their annual fixed costs,” he added, saying that the lack of profitability for coal would accelerate plant closures.

In Europe, with electricity generally sold on day-ahead markets, renewable capacity is constructed over a much longer time scale, Jones said. Wind and solar projects are built through 15-to-20-year auction contracts where “prices have collapsed”.

But in contrast to the “collapse” of coal, the increase in the affordability of renewables is seen as an overwhelmingly positive development – for customer cost savings and help in the uphill battle against global warming.

Yet, Jones said, it may be hard to predict the evolution of the market price for carbon, which climate advocates see as part of a tool box that also includes rapid progress for renewable installations and energy efficiency improvements.

Carbon pricing appears to level the playing field between different generation sources. However, Jones added, “You don’t know what’s going to happen [with the exact price] until you know what kind of regulation will get brought in.”

Stricter rules made by lawmakers in Brussels in the future could keep the carbon price at its currently elevated level, incentivising an accelerated transition from fossil fuels.

Wind and solar surge

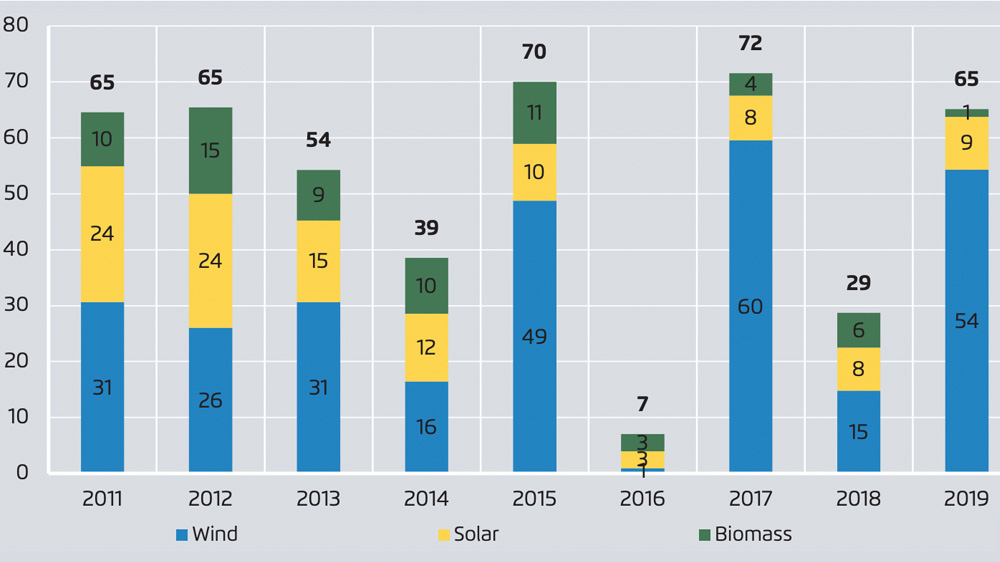

In 2019, wind power grew 14 percent, in part due to more favourable weather conditions. Electricity from solar panels increased seven percent.

All EU member states except one saw a rise in the wind and solar components of their energy mix.

Meanwhile, hydropower shrunk six percent as a result of ongoing drought, while nuclear power – reliant on river water for cooling – was also impacted by summer dryness.

EU goals state that one-third of total energy must come from renewables by 2030. But that will require an annual addition of 97 terawatt hours for the next 10 years. Despite soaring to record heights this year, renewables added just 64 terawatt hours.

Wednesday’s report from Agora Energiewende said that “the EU must reduce the number of issued [carbon] permits faster than previously planned if it wants the emissions trading system to be effective”.

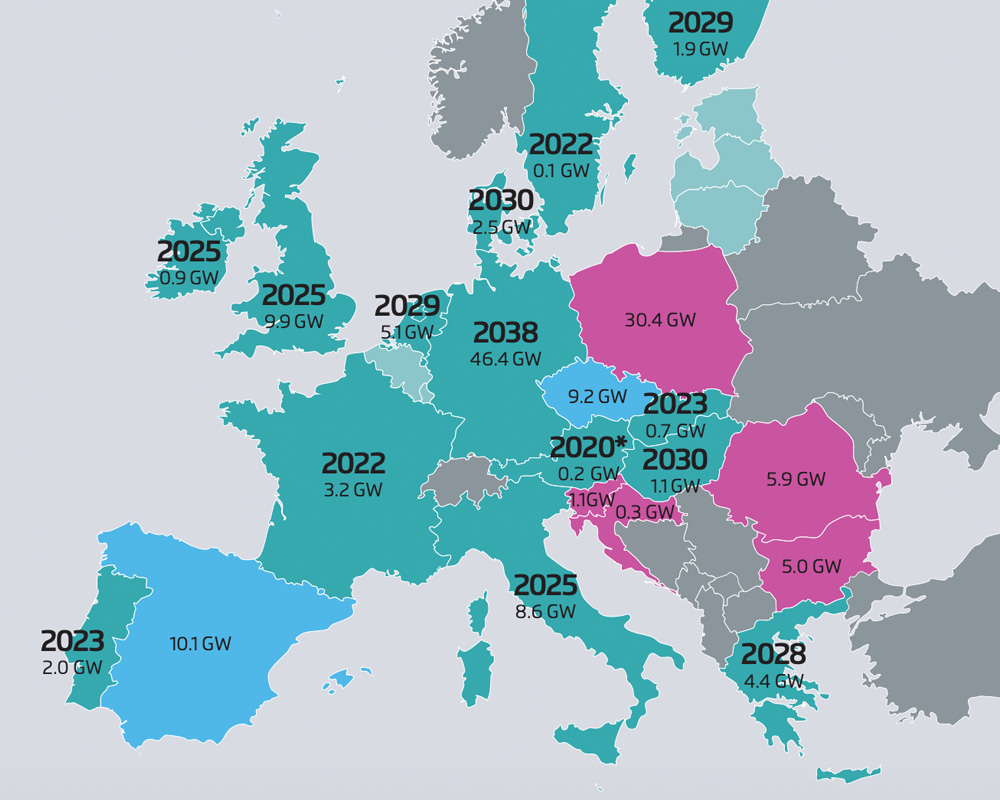

The report also said that the UK, Ireland and Spain have been most ambitious thus far in expanding renewables. This investment has driven down their electricity costs and made those countries less dependent on both energy imports and carbon prices.

Broadly speaking, European economic output has grown, albeit slowly, even as electricity consumption shrinks.

As 21 EU members have coal phase-out plans, these trends are likely to continue. But a number of Eastern European countries remain wedded to the combustible black rock.

“Poland, the Czech Republic, Romania, and Bulgaria continue to depend heavily on lignite power and have yet to develop phase-out plans,” said Jones.

“Such plans are necessary not only to create a coal-free EU but also because lignite power plants have swung from being an asset to a liability as lower electricity prices and higher carbon prices in 2019 have crushed their economics.”