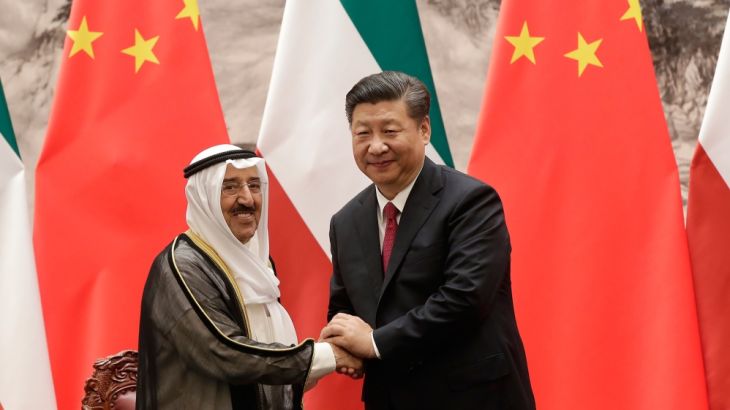

China in the Middle East: Behind Xi’s economic charm offensive

We examine why China is pledging billions of dollars in loans and aid to revive growth in the Middle East.

China, the world’s second-largest consumer of crude, has stepped up its investment in the oil-rich Middle East with a pledge of more than $23bn in loans and millions more in aid.

President Xi Jinping also wants talks on free trade areas and is putting forward an “oil and gas plus” investment model to representatives of 21 Arab nations at a forum in Beijing. He believes it’s a model that can create jobs and helps safeguard China’s future energy requirements.

Keep reading

list of 4 itemsPalestinian Prisoner’s Day: How many are still in Israeli detention?

‘Mama we’re dying’: Only able to hear her kids in Gaza in their final days

Europe pledges to boost aid to Sudan on unwelcome war anniversary

China needs friends. And this is good timing to make friends by announcing $23bn in economic largesse.

Xi told Arab leaders that China would like to form a strategic partnership to become “the keeper of peace and stability in the Middle East … and good friends that learn from each other.”

The Middle East plays a vital role in the billion-dollar One Belt One Road Initiative, a megaproject that aims to link people in Asia, Africa and Europe via an ultramodern trade route. It is a reinvention of the ancient Silk Road for the modern age.

Middle East countries currently provide more than half of China’s crude oil imports and China is the largest trading partner with the region. Its goal is to double its Middle East trade to $600bn by 2020.

So, what is behind Xi’s latest economic charm offensive in the Middle East?

|

|

“This is part of a long-term plan of China to secure its resources for the future,” says Reuben Mondejar, professor for Asian initiatives at the IESE Business School at University of Navarra, Barcelona.

“Oil is very important; energy resources for China will be more and more crucial in the coming 10 years, 20 years, 30 years. So, they have already invested in other places like Africa and South America for other resources. But for the oil, the Middle East is the primary area, and the platform that they are conveniently using now is the Belt and Road.”

Mondejar believes it’s all about timing, “because of the current situation with the trade war and all of this isolationism, protectionism … China needs friends. And this is good timing to make friends by announcing $23bn in economic largesse.”

But according to Mondejar, an economic partnership with the “Middle East is more problematic than [with] South America, for example. The Middle East is probably the most volatile region in the world at the moment, so China is stepping into a very difficult area.”

Also on this episode of Counting the Cost:

Ethiopia-Eritrea peace: We examine how the economic landscape in the Horn of Africa is changing as a new era of peace looms. Mohammed Adow reports from Addis Ababa on the state of Ethiopia‘s economy. And Charles Robertson, chief economist at Renaissance Capital, discusses the challenges that lie ahead.

From quantum computing to 3D printing: We look at the world’s best innovators in 2018 and what it means if you live in a country that didn’t make the top 10. Francis Gurry, director general of the World Intellectual Property Organization, discusses the economics of innovation.

Safe or cancer causing? Monsanto’s Roundup, one of the world’s most profitable and widely used weedkillers, goes on trial. Kristen Saloomey reports from New York.

This tax must go: Malcolm Webb reports from Kampala on protests against a government move to tax social media apps in Uganda.