European bank leaders debate debt crisis

Declining bond prices in Spain and Italy may prompt the European Central Bank to resume buying government bonds.

|

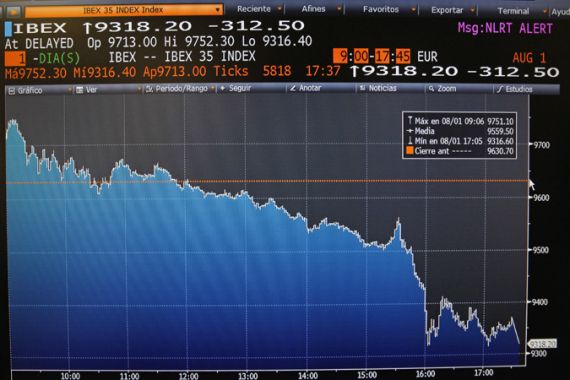

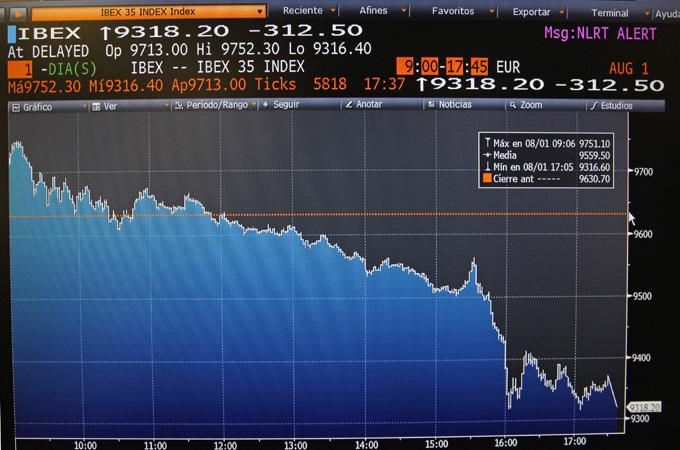

| Stock markets in Spain have been declining amid fears that the country will go bankrupt [EPA] |

The European Central Bank (ECB) is meeting to discuss the debt crisis that is threatening to spread to Italy and Spain and putting the future of the euro currency at risk.

Participants at Thursday’s meeting in the German city of Frankfurt were to take a decision on interest rates, but the primary concern was on how much it costs both Italy and Spain to borrow money.

Keep reading

list of 4 itemsChina’s economy beats expectations, growing 5.3 percent in first quarter

Inside the pressures facing Quebec’s billion-dollar maple syrup industry

Manipur’s BJP CM inflamed conflict: Assam Rifles report on India violence

Both countries are now drawing close to what is being seen as unmanageable levels of debt, which could lead to more bailouts. Bank leaders were to discuss on Thursday whether the bank would resume buying government bonds as a measure to quell the crisis.

Three Eurozone countries – Greece, Ireland and Portugal – have already had cash bailouts from the EU and the IMF as they remain stuck in deep economic morass due to the debt crisis.

The chief European economist for Standard and Poor’s, Jean-Michel Six, said markets expect the ECB will reactivate its bond-buying operation to calm market turmoil.

“Markets are still moving so we need someone to intervene,” he said. “The only effective fireman capable of getting us out of the building quickly is the ECB which, since the beginning of the crisis, has played an admirable role to calm markets.”

ECB bond purchases have been an effective way to stem panic or speculative selling of sovereign bonds that drives up the cost of borrowing for heavily indebted governments.

But the ECB suspended its purchases 18 weeks ago because they forced it to shoulder an increasing amount of risk that the bank’s president, Jean-Claude Trichet, insists should be borne by the governments themselves.

Declining bond prices

The ECB bought 76bn euros of sovereign bonds, believed to be only Greek, Irish and Portuguese, to stabilise markets last year but critics said the Securities Market Programme had only limited, short-term impact and did not prevent any of those countries from requiring EU/IMF bailouts.

However, sharp declines in Italian and Spanish government bond prices, sending yields to record highs in recent days, have prompted speculation that the ECB will opt to resume the programme to support the government’s bond markets.

|

|

“A revival of the ECB’s securities markets programme is the only real option that would prevent a liquidity crisis for Spain and Italy,” Goldman Sachs economist Dirk Schumacher said.

The yield on Spain’s 10-year bonds climbed as high as 6.5 per cent on Wednesday because of investor doubts

about Madrid’s ability to continue financing its debt over the long term.

Italy’s 10-year yield fell back below the 6.0 per cent threshold, with some traders saying they expected the ECB could act, either with a longer term repo or secondary market bond-buying.

Analysts say that if yields go much higher and stay there, markets could force Spain, the euro zone’s fourth biggest economy, to follow Greece, Ireland and Portugal in seeking an international bailout.

Euro zone leaders agreed at a summit last month to give the bloc’s bailout fund sweeping new powers to help indebted states and intervene in the bond market, but the changes are unlikely to be passed by national parliaments until late September at the earliest.

The ECB is expected to leave its key refinancing rate unchanged at 1.5 per cent, after raising rates twice since April.

The outlook for global interest rates has swung away from the sort of steady tightening begun by the ECB earlier this year and the bank meets just a day after Switzerland delivered a shock cut in its already very low rates.

The Bank of Japan also eased monetary policy by boosting asset purchases on Thursday and signalled its determination to support Tokyo’s solo currency intervention to weaken the yen.