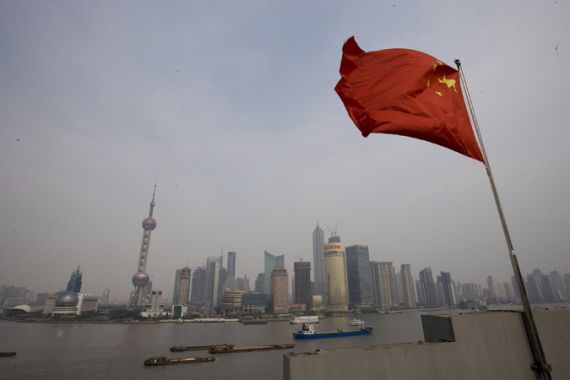

Chinese manufacturing activity slows

Weak performance underscores case for monetary stimulus as EU crisis weighs on world’s second-largest economy.

| Al Jazeera’s Harry Fawcett says Chinese manufacturing activity has contracted for the first time in almost three years |

China’s manufacturing has recorded the weakest performance since the global recession eased in 2009, official data showed, vindicating Beijing’s move to free up credit as global woes hit its exports.

The purchasing managers’ index (PMI) compiled by the China Federation of Logistics and Purchasing (CFLP) fell to 49 in November, down 1.4 points from October, the CFLP said in a statement on Thursday.

Keep reading

list of 4 itemsBoeing hit with 32 whistleblower claims, as dead worker’s case reviewed

US imposes new sanctions on Iran after attack on Israel

A flash flood and a quiet sale highlight India’s Sikkim’s hydro problems

A reading above 50 indicates the sector is expanding while a reading below 50 suggests a contraction.

HSBC said its manufacturing activity index also fell to a 32-month low of 47.7 in November from 51 in October, slightly worse than preliminary data released last week and signalling a “solid deterioration” in the sector.

The data comes a day after China reduced the amount of money banks must keep in reserve – the first cut in three years – as it looks to ease monetary policy in the face of a slowing economy.

‘Shocking’ data

Alistair Thornton, an analyst at IHS Global Insight, said the “shocking” data showed the world’s second-largest economy was “sagging under the weight of this year’s credit tightening”.

|

“The message is clear: the economy is slowing much faster than expected and the [Chinese] government has stepped into the ring. The loosening campaign has begun“ – Alistair Thornton, |

Most of the measures in the official survey deteriorated in November, with new orders and new export orders contracting, suggesting weakening demand in China as well as Europe and the US for Chinese-made products.

The weak figures signalled that China’s economy “would continue to slow”, said Zhang Liqun, a government analyst.

However, he ruled out a “huge downfall” in the Asian powerhouse due to the strength of domestic investment and consumption.

Qu Hongbin, a HSBC chief economist in China, said the data, combined with a faster than expected easing in inflation, implied “growth is set to overtake inflation as Beijing’s top policy concern”.

But Credit Suisse analysts played down fears of a sharp slowdown in economic growth, saying the PMI data was weak but was “not collapsing to the below-40 level as was seen in 2008”.

| Counting the Cost – China: Bailing out the world |

On Wednesday, authorities cut bank reserve levels for the first time since 2008 to help boost lending and stimulate growth to counter alarming signs of a domestic slowdown and the crisis in key export markets.

The announcement overshadowed the weak PMI data, with Chinese shares closing up 2.29 per cent at 2,386.86 on expectations for further credit easing.

Analysts had forecast such a move after the central bank said recently it would “fine-tune” monetary policy amid growing concerns that the weak global economy is increasing the risk of a sharp slowdown in China.

“The message is clear: the economy is slowing much faster than expected and the government has stepped into the ring. The loosening campaign has begun,” Thornton said.

“We expect this to feed through into slower industrial production growth numbers for November, and slower gross domestic product numbers for the fourth quarter.”

Consumer inflation

The move to boost lending, which analysts estimate unlocked about $55bn (350 billion yuan) in liquidity, is the strongest signal yet that the government wants to ease tight credit restrictions put in place to curb surging inflation and property prices – now showing signs of easing.

China’s property market, a mainstay of the Asian country, has faced slumping sales and prices nationwide amid tough government restrictions on property purchases and bank lending.

The average price of residential properties in 100 Chinese cities fell 0.28 per cent in November from October, marking the third consecutive month on month fall, according to real estate research firm China Index Academy.

China’s consumer inflation eased in October to 5.5 per cent, the slowest pace since May, while exports and imports sank in October as slowing growth in China and overseas woes undermined demand for Chinese goods.

Economic growth also slowed to an annual 9.1 per cent in the third quarter from 9.5 per cent in the previous quarter.

China, anxious about rising living costs, has pulled on a variety of levers to control price rises in the past two years, including increasing interest rates five times since October 2010.