Should investors fear purges in Saudi Arabia?

At least 1,700 bank accounts have reportedly been frozen since the crackdown began, with the number expected to rise.

Saudi Arabia’s central bank has moved to allay investor fears amid an ongoing campaign of arrests targeting some of the country’s richest people, including members of the royal family.

In a statement issued on Wednesday, the Saudi Arabian Monetary Agency said the round-up, which is ostensibly aimed at ending corruption, would not affect businesses associated with those arrested.

Keep reading

list of 4 itemsEcuador weighs security, international arbitration in latest referendum

‘Triple spending’: Zimbabweans bear cost of changing to new ZiG currency

Boeing hit with 32 whistleblower claims, as dead worker’s case reviewed

“Bank accounts that have been frozen for individuals involved in corruption cases do not include the bank accounts of the companies in which they have ownership,” the statement said.

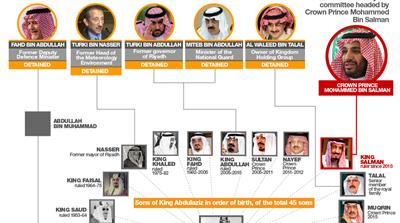

On Saturday, Crown Prince Mohammed Bin Salman launched a purge of his rivals within the royal family and the country’s business elite.

Those arrested include: his cousin (and Saudi Arabia’s richest man) Alwaleed bin Talal; at least 11 other princes; four ministers; and several more ex-ministers.

Waleed al-Ibrahim, chairman of the Middle East Broadcasting Center (MBC), one of the region’s largest media companies, and construction magnate, Bakr Binladin of the Saudi Binladin group, were also arrested.

The purge was later expanded to include others and at least 1,700 bank accounts have been frozen so far, with the number expected to rise, according to the Reuters news agency.

Former crown prince, Mohammed Bin Nayef, who has not been seen publicly since June and is believed to be under house arrest, also had his accounts frozen.

According to the Wall Street Journal journal, the newly formed anti-corruption committee is aiming to seize up to $800bn in assets from those arrested.

Saudi Arabia’s close ally, the United Arab Emirates, has also ordered its banks to provide details of accounts held by the detained princes and other Saudi nationals.

Diminishing reserves

If successful, the money raised from the sale of those assets could help to replenish the country’s diminishing foreign currency reserves, which stood at $487bn in July this year, down from a high of $737bn in August 2014.

Since the oil price crash of mid-2014, Saudi Arabia’s GDP growth has contracted from 3.7 percent growth that year to a predicted growth of just 0.1 percent in 2017.

Saudi Arabia’s benchmark stock index, Tadawul, does not seem to have been significantly impacted by the events of the last week, with losses and gains well within the bounds of everyday trading.

However, how much of that is down to government intervention is up for debate.

A Reuters report on Wednesday citing “asset managers” in the country said government-linked investment funds were buying shares to support the market.

In terms of long-term affect, Bin Salman’s consolidation of power creates a previously unseen level of political instability that could affect the Saudi economy.

In an opinion piece published November 8, Fitch Ratings said “the arrests of members of the Saudi royal family, current and former ministers and prominent businessmen increase political uncertainty in Saudi Arabia.”

The ratings agency explained the concentration of power in the crown prince’s hands would bolster “economic and social reform efforts” but came with the risk of backlash from within the royal family and from Saudi citizens unhappy with the changes.

Reforms

Bin Salman’s political consolidation has come coupled with an ambitious programme of social and economic reforms aimed at modernisation the country.

Socially the crown prince has promised to return to a “moderate” form of Islam and end the country’s infamous prohibition against women driving.

Fiscally, the prince has pledged to transform the country’s economy by ending its dependence on oil, develop new technologies, cut welfare costs, introduce taxes, and privatise state-owned assets.

The plan, dubbed Vision2030, is seen as Mohammed Bin Salman’s flagship policy and his success will likely be tied to that of the reforms he is implementing, according to analysts.

A Chatham House paper published in August warned that if the plan was unsuccessful “existing criticisms of his individual leadership style are likely to deepen among those who resent his rapid rise.”

According to financial experts the flagship public flotation of the Saudi state-owned oil company, Aramco, also comes with a degree of difficulty for the crown prince, especially given the ongoing purges.

A recent Financial Times editorial suggested potential investors in the company would be put off by the arrests of senior Saudi royals.

“(…) foreign investors will have qualms about the governance of the state oil company,” it said, adding: “Any ruler who arrests his relatives will not listen much to minority shareholders.”