BP posts first profit since spill

British-based oil giant posts first profit since the catastrophic Gulf of Mexico oil spill in April.

|

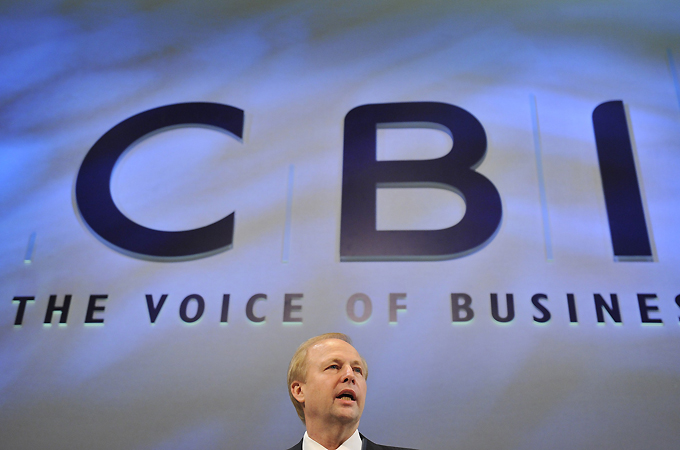

| BP posted a profit under Bob Dudley, the group’s new CEO [Reuters] |

BP has posted its first profit since the oil spill in the Gulf of Mexico in April, but the British oil giant says it still cannot estimate the full cost of the disaster.

The petroleum company returned to profit on Tuesday with a net profit of $1.79bn. Replacement cost profit was $1.85bn, far below the $4.5bn that analysts were predicting.

Keep reading

list of 4 itemsPalestinian Prisoner’s Day: How many are still in Israeli detention?

‘Mama we’re dying’: Only able to hear her kids in Gaza in their final days

Europe pledges to boost aid to Sudan on unwelcome war anniversary

The third quarter profit came after a loss of $17.2bn in the second quarter but remained lower than a profit of $5.34bn from the previous year.

Speaking to Al Jazeera, David Buik, a market analyst at BGC Partners, said: “We have to remember in BP’s defence that there was no production in the Gulf at all, and that was responsible for 10 per cent of income for BP.

“I would hope in the next few years we will see a very strong performance.”

Replacement cost profit was $1.85bn, well below analysts’ forecasts.

Earnings were dented by a pretax charge of $7.7bn, bringing the total charges this year to $39.9bn.

Escrow fund

BP’s exploratory Macondo well blew out on April 20, and continued gushing out oil until July 15.

The third-quarter report was the first for the company under Bob Dudley, its new chief executive, who replaced Tony Hayward.

Third-quarter expenses included the spill response, containment, relief well drilling, grants to affected US states, claims paid and money owed to the US government.

“The amount provided for future costs reflects ongoing response, remediation and assessment efforts, BP’s commitment to the Gulf of Mexico Research Initiative, estimated legal costs expected to be incurred in relation to litigation, remaining payments to the escrow account, claims centre administration costs and an amount for estimated penalties for strict liability under the Clean Water Act,” BP said.

BP is building up an escrow fund to pay for the spill by raising around $30bn from selling assets.

It has already has raked in around $9bn from the sale of assets in Egypt, Canada, the US and Colombia.