Stocks slump on historic AIG loss

Stocks fall to 11-year low as firm registers largest-ever US quarterly loss.

The credit crisis and recession have slashed the index’s value since it hit a record high of more than 14,000 in October 2007.

And Al Jazeera’s John Terrett in New York says the poor stock market performance could continue on Tuesday as US politicians in Washington DC will be hearing from Ben Bernanke, the chairman of the US Federal Reserve, plus Timothy Geithner, the US treasury secretary, and chief executives from the US’s big three automakers.

Taxpayer aid

The dive in AIG’s profits, equal to $22.95 a share, was the company’s fifth consecutive quarterly loss, and its value has now fallen by more than $100bn over the last five quarters.

AIG received $150bn in aid from the US taxpayer last year, but the US Treasury Department and US Federal Reserve said that the ongoing financial crisis meant more assistance was likely to be needed.

| In video |

|

Florida faces construction crisis |

“The treasury department will create a new equity capital facility, which allows AIG to draw down up to $30bn as needed over time,” they said in a joint statement.

“Given the systemic risk AIG continues to pose and the fragility of markets today, the potential cost to the economy and the taxpayer of government inaction would be extremely high.”

Al Jazeera’s John Terrett in New York said that the government had also loosened the terms on AIG’s outstanding loans, allowing it to pay less in interest.

The new aid package calls for the Federal Reserve to take stakes in two of AIG’s international units.

Instead of paying back $38bn in cash with interest that it has used from a Federal Reserve credit line, AIG will repay it with equity stakes in Asia-based American International Assurance and American Life Insurance, which operates in 50 countries.

|

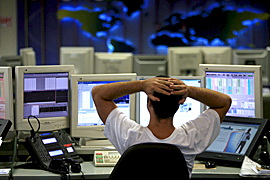

| World markets have fallen amid concerns about the US economy [EPA] |

AIG has been unable to find buyers for parts of the company that it had hoped to sell off in order to make repayments on its existing loan.

Max Fraad Wolff, a US economist, told Al Jazeera that AIG was still suffering from the effects of insuring debts owed to banks that had not been paid.

“In an unregulated environment AIG wrote insurance many hundreds of billions of dollars greater than it could possibly pay out if these assets went bad – and they did go bad.”

“The bigger problem is they keep going bad that the government keeps paying them off for the money they are losing as the assets they insured go bad.”

Help needed

Edward Liddy, the chairman and chief executive of AIG, insisted that the firm would pay back its debt to the taxpayer.

“The new $30 billion is a standby line. It’s not necessarily something that we think we’ll have to draw on right away,” he told the NBC news channel on Monday.

But Liddy backed away from earlier statements about repaying the company’s debt to the government in full within two years.

“It is clearly our goal. But we need some help from the financial marketplace,” he said.

Economic woes

The stock market fall came after European and Asian markets also reported losses on Monday amid continuing fears over the ailing US economy.

In London, the FTSE 100 index lost 5.33 per cent, – its worst finish since 2003 – while in Frankfurt the DAX fell 3.48 per cent and in Paris the CAC 40 slumped 4.48 per cent.

The US government also announced that construction spending plunged more than twice as much as expected in January, the fourth consecutive monthly decline.

The commerce department said on Monday overall construction spending had dropped 3.3 per cent in January.

And in more bad news for the US economy, the chief executive of government-backed mortgage firm Freddie Mac also said he was resigning after less than six months in the job.

David Moffett is step down as chief executive in March as the struggling firm plans to ask the government for up to $35bn in additional aid.