People, planet and profits: Impact investing exceeds $500bn

Annual survey shows investors ‘increasingly see alignment between business objectives and transformative impact’.

In a world where the dual scourges of immense poverty and global warming often overwhelm even the most optimistic people, investors of a new breed are stepping into the breach and staking hundreds of billions of dollars on solving the massive problems facing humankind.

But this path to positive impacts isn’t just about doing good. It’s also about making money.

Keep reading

list of 4 itemsHow one Mexican beach town saved itself from ‘death by tourism’

Rio Mayor on hosting World Cup, Olympics together: ‘DON’T!’

COP28 Dubai is over: Four key highlights from the UN climate summit

“Global challenges like entrenched inequality and climate change require large-scale, urgent action,” Amit Bouri, CEO of the Global Impact Investing Network (GIIN), told Al Jazeera. “And impact investors are stepping up to help fuel positive progress.”

Impact investors are institutions and individuals deliberately aiming to make a measurable, positive impact socially and/or environmentally, as well as a healthy financial return. According to the GIIN’s latest annual survey, this investment strategy is winning more converts – and crucially, it’s gaining capital, too.

“They are accounting for considerations that have long been ignored in the financial sector: the impact of investments and businesses on people and the planet,” Bouri said, adding that client demand “demonstrates the powerful potential for people to influence positive change in the financial system”.

In its annual survey released on Wednesday, the GIIN highlighted the sizable business accomplishments – and staggering challenges ahead – for a growing niche in the finance world.

Half-trillion-dollar sector

The 2019 report is billed as the most comprehensive source of data on the market for impact investing.

The 266 respondents interviewed said they manage $239bn in assets across different geographies and sectors, with half of that amount allocated to developed markets and half to emerging markets.

The GIIN estimates the size of the impact investing industry to be $502bn globally, meaning that the survey covered almost half of the total assets under management that are considered “impact investments”.

With the industry continuing to expand, the report reveals that measurement of impact is key for investors, most of whom say the performance of their investments has met their expectations for both impacts and for financial returns.

Yet impact investing still falls far short of closing the funding gap between what governments, companies and non-governmental organizations currently spend – and what the world needs – to fix the most dire issues.

Ending world poverty would cost close to $200bn in annual development funding, according to Jeffrey Sachs, the director of the Earth Institute at Columbia University.

And the global price for mitigating climate change approaches $2.5 trillion annually to cut carbon emissions and deploy green-energy investments through 2035, according to the United Nations.

That is five times the half-trillion-dollar total of all impact investments made to date.

However, the broader international market for all socially responsible and sustainable investment – of which impact investing constitutes a relatively small chunk – has reached $12 trillion.

Transcending ‘business objectives’

The GIIN works with organisations ranging from JPMorgan Chase and UBS Group AG to the Gates and Rockefeller foundations. The network consists of about 300 partners across six continents.

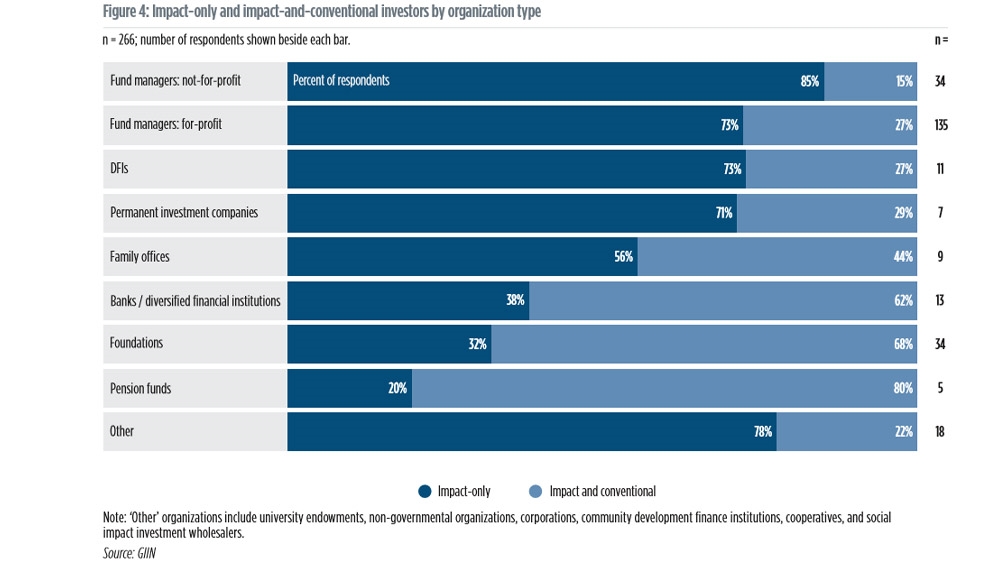

Around two-thirds of the GIIN survey’s respondents were fund managers, while the rest included foundations, banks, family offices, pension funds and development finance institutions.

Two-thirds of those surveyed make only impact investments, while the rest also make conventional ones.

Respondents said they plan to invest in more than 15,000 deals over the course of 2019. The average respondent managed $912m, while the median respondent managed $82m – implying that a handful of the managers at the top oversee vast sums of investment capital.

“We are starting to overcome challenges that used to stop conversations before they started, such as the misperception that financial trade-offs are necessary across all impact investment strategies,” said Sapna Shah, managing director at the GIIN.

“Fully one-third of survey respondents are motivated to make impact investments because of – not in spite of – their financial return potential,” she added. “This shows investors increasingly see alignment between business objectives and transformative impact.”

But, Shah said in the report, the current amount of money in impact investments is “nowhere near enough” to remedy the “devastation of climate change or the savagery of unequal access to the most basic of services”.

Most respondents had both social and environmental impact objectives, although some target just one or the other. Four-fifths said that a desire to work for a mission-driven organisation motivates their staff, and a similar percentage said they were interested in aligning their careers with personal values.

In terms of sector, 15 percent of respondents were investing in energy, 13 percent in microfinance, 11 percent in other financial services, and the rest in a variety of fields such as food, housing, healthcare, forestry, infrastructure and education.

Among the fastest-growing sectors are WASH (water, sanitation and hygiene) and ICT (information and communications technology).

Almost half of the respondents were in North America, while about a quarter were in Western Europe. The regions that experienced the most growth were MENA (Middle East and North Africa) and South Asia.

The vast majority of survey respondents reported progress in the availability of research and the sophistication of impact measurement.

But a significant minority signaled that a lack of liquidity was a substantial concern.

Impact measurement

The GIIN, a nonprofit organisation supported by the United States Agency for International Development, also asked respondents about how they measure impact – which the GIIN noted “is fundamental to scaling the impact investing market”.

Nearly all respondents said they use a mix of qualitative information, proprietary metrics and measurements aligned to IRIS – the framework developed by the GIIN for this purpose.

In May, the GIIN launched IRIS+, a new system for managing impact that provides the industry with a suite of tools to optimise investments, minimise confusion, increase comparability and facilitate communication of results.

“Standardising the way we measure and communicate impact is important for transparency,” said Mitzi Perez Padilla, whose organisation Oikocredit has contributed to IRIS.

She said the metrics system “will help new entrants to the sector be accountable” to investors.

Sixty percent of investors said they track performance with the United Nations Sustainable Development Goals while “driven by a desire to integrate into a global development paradigm”. The themes that they sought to address were employment, poverty, inequality and health.

Over 90 percent said their performance was in line with or exceeded both their impact and financial expectations, while around 15 percent said they outperformed expectations. Emerging-market investments also tended to do better than developed-market investments, though with greater variance, respondents said.

The GIIN, which was founded in 2009, describes itself as the “leading global champion of impact investing, dedicated to increasing the scale and effectiveness of impact investing around the world”.